Yes, you can get a £5000 loan with bad credit in the UK through direct lenders, installment loans, and specialist providers offering flexible terms.

For many people with poor credit histories, accessing a loan seems impossible. However, several lenders in the UK offer £5000 loans specifically designed for individuals with bad credit.

This guide explains loan types, eligibility criteria, application steps, and the pros and cons to help you make an informed decision in 2025.

What Are £5000 Bad Credit Loans?

A £5000 bad credit loan is a financial product tailored for borrowers with a poor credit history or low credit score. Key features include:

Loan amounts typically ranging from £1,000 to £5,000

Flexible repayment terms, often between 6–60 months

Higher interest rates compared to prime loans, due to the added risk

These loans can be secured (using assets like a car or property) or unsecured (based on income and affordability rather than collateral).

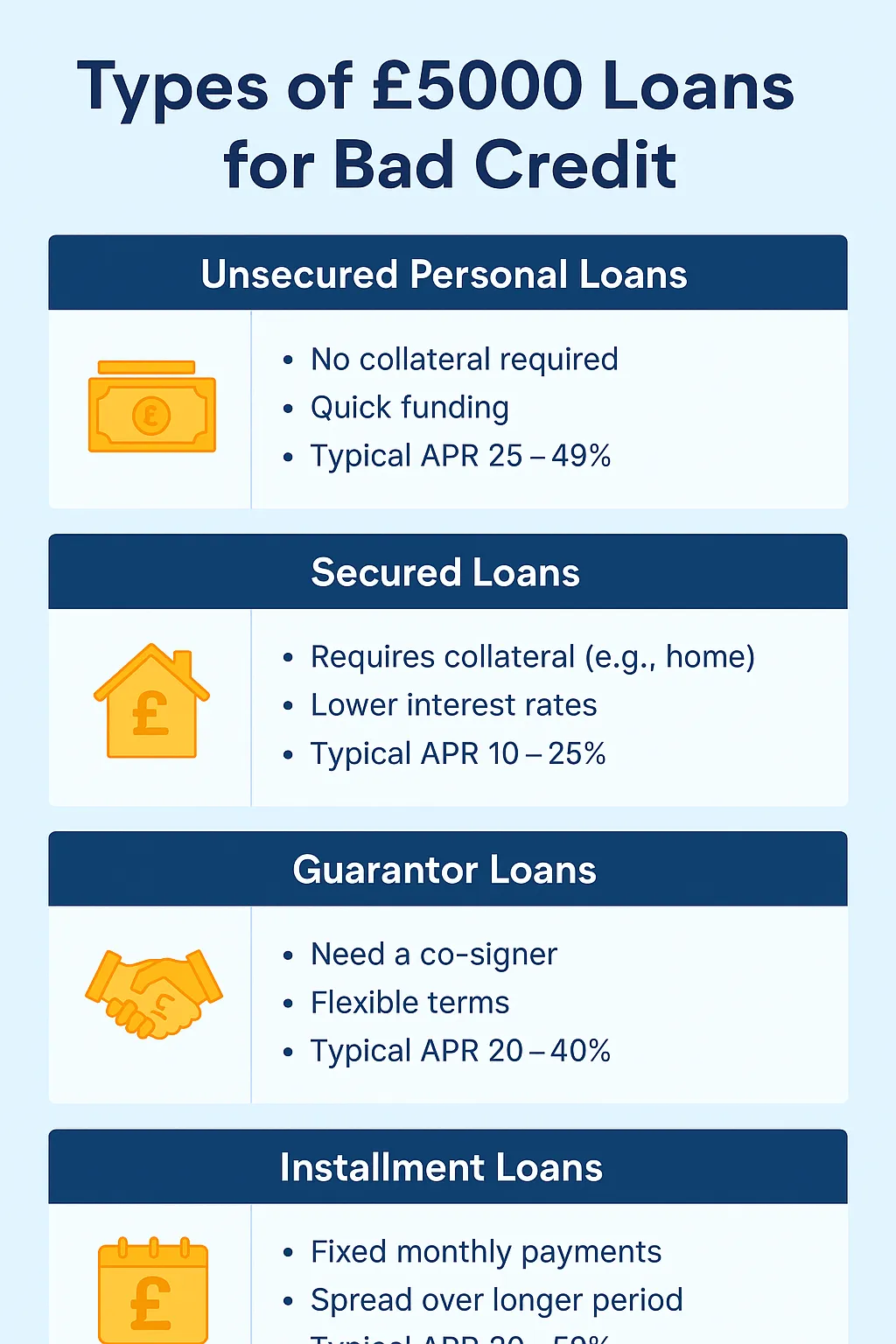

Types of £5000 Loans for Bad Credit

| Loan Type | Typical APR Range | Repayment Term | Suitable For |

|---|---|---|---|

| Unsecured Personal Loans | 25–49% | 6–36 months | Quick funding, no collateral |

| Secured Loans | 10–25% | 12–60 months | Homeowners, lower rates |

| Guarantor Loans | 20–40% | 12–60 months | Applicants with a willing co-signer |

| Installment Loans | 30–50% | 6–48 months | Spread repayments over longer periods |

| Credit Union Loans | 12–30% | 6–36 months | Members with lower-income backgrounds |

200 Pound Loan – Quick & Easy Cash Options in the UK

Direct Lenders vs Brokers for £5000 Bad Credit Loans

When searching for a £5000 loan with bad credit, you can either apply directly to lenders or use a broker service.

Direct Lenders

Provide loans directly without intermediaries

Offer faster decisions and direct communication

May have stricter eligibility requirements

Brokers

Match you with multiple lenders using one application

Can improve approval chances for bad credit applicants

May charge fees or earn commissions from lenders

Comparison Table

| Feature | Direct Lenders | Brokers |

|---|---|---|

| Speed | Same-day decisions | Slightly longer |

| Approval Chances | Moderate | Higher (multiple lenders) |

| Costs | Lower fees | Possible broker fees |

| Best For | Simple applications | Wider lender access |

Installment Loans for Bad Credit £5000

An installment loan allows you to borrow a fixed amount, such as £5000, and repay it in equal monthly installments over a set term.

Advantages:

Predictable monthly payments

Longer repayment terms reduce financial strain

Improves credit score if paid on time

Typical Features:

Loan terms from 6–48 months

Interest rates vary by credit score and lender type

Available from direct lenders, credit unions, and specialist online providers

Best for: Borrowers seeking manageable monthly payments rather than short-term lump sum repayments.

Do No Credit Check Loans Exist? Truth Behind the Offers

£5000 Cash Loans for People with Bad Credit

Some lenders in the UK offer cash loans up to £5000 specifically for people with bad credit. These loans are usually:

Short to medium-term – repayable over 6–36 months

Unsecured or secured – depending on your income and credit profile

High-cost – interest rates are often higher due to risk

What to watch out for:

FCA-regulated lenders only

Avoid payday lenders with excessive APRs

Check for hidden fees or early repayment charges

Tip: Cash loans can be fast, but always compare APRs, fees, and repayment terms before signing any agreement.

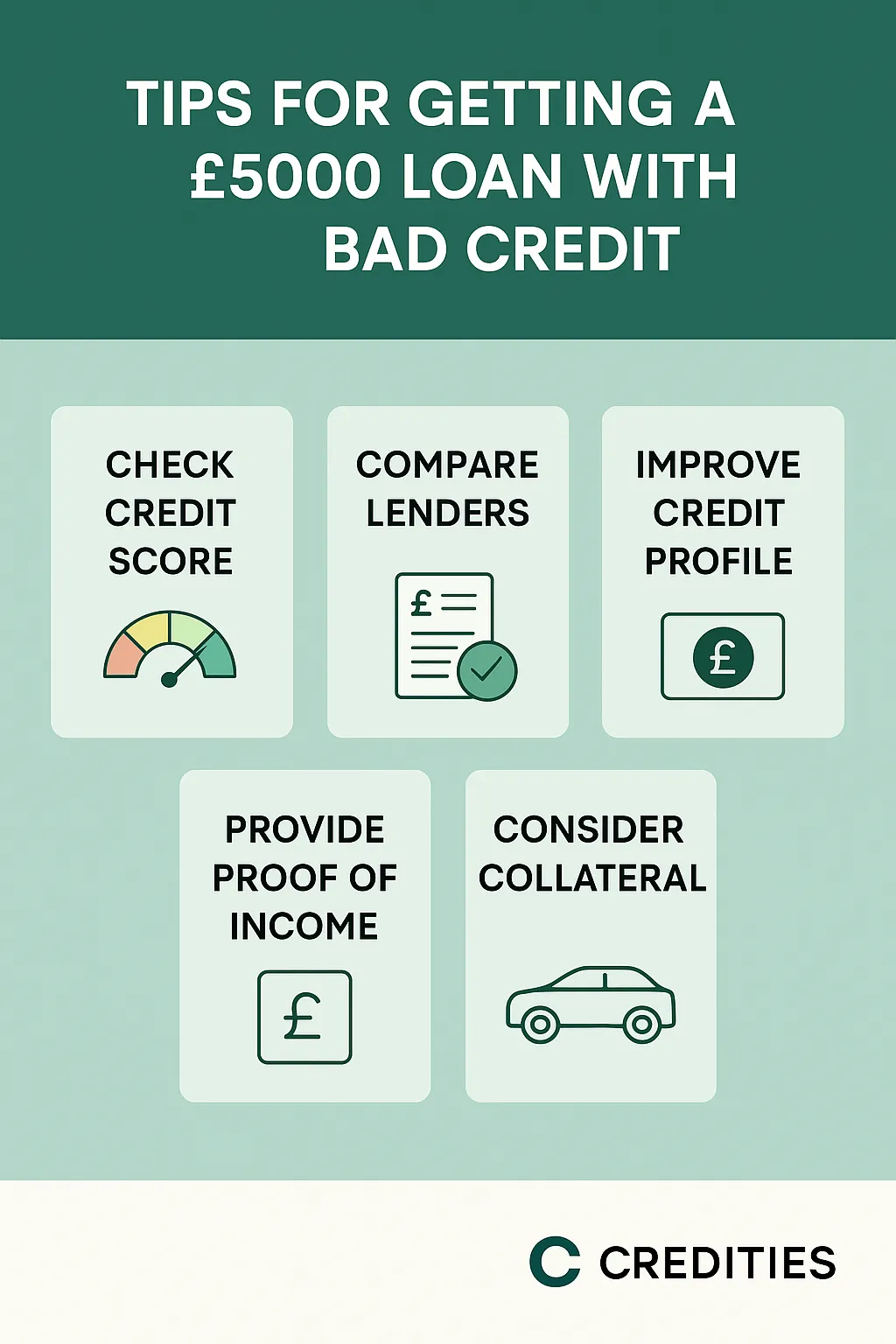

Eligibility Criteria for £5000 Bad Credit Loans

Most lenders offering £5000 loans for bad credit in the UK have common eligibility requirements:

Age: Minimum 18 years old

Residency: Must be a UK resident with a UK bank account

Income: Proof of stable income or employment required

Credit History: Past defaults acceptable with affordability evidence

Documentation: ID, proof of address, and recent bank statements

Some secured loans may require collateral, while guarantor loans need a co-signer with better credit history.

How to Apply for a £5000 Loan with Bad Credit (Step-by-Step)

Step 1: Check Eligibility

Use free eligibility checkers from FCA-authorised lenders

Step 2: Gather Required Documents

ID, bank statements, income proof, and address verification

Step 3: Compare Lenders

Look at APR, repayment term, and customer reviews

Step 4: Submit Application Online

Many lenders offer same-day decisions if you apply early

Step 5: Review Loan Agreement Carefully

Check total repayment cost, fees, and repayment schedule

Step 6: Receive Funds

Some lenders provide same-day funding if approved before cut-off times

Pros & Cons of £5000 Bad Credit Loans

| Pros | Cons |

|---|---|

| Access to funds despite poor credit history | Higher interest rates than standard personal loans |

| Flexible repayment terms (6–60 months) | Risk of rejection with very low income or unstable finances |

| Can improve credit score if repayments are on time | Secured loans risk collateral if payments are missed |

| Multiple lender options including credit unions | Broker fees may apply in some cases |

Alternatives to £5000 Bad Credit Loans

If you don’t qualify for a £5000 loan or want to explore cheaper options, consider:

Credit Union Loans: Lower interest, community-based lending

Government Hardship Loans: Short-term emergency support for low-income households

- Alternative Ways to Access Credit if You Have a Low Credit Rating

Salary Advance Schemes: Some employers offer early access to wages

Borrowing from Family or Friends: Interest-free if handled responsibly

Smaller Loan Amounts: Easier approval and lower interest for shorter repayment terms

H2: FAQs

Can I get a £5000 loan with bad credit and no guarantor? → Yes, some lenders offer unsecured £5000 loans without a guarantor, but rates may be higher.

How long does it take to get approved? → Some direct lenders offer same-day approval if you meet all eligibility criteria.

Are secured loans cheaper than unsecured loans? → Generally, yes — secured loans often have lower interest rates due to collateral reducing risk.

Will a £5000 bad credit loan improve my credit score? → If repaid on time, it can help rebuild your credit profile over time.

Are credit unions better for bad credit loans? → Credit unions usually have lower rates and more flexible criteria than payday lenders.