Doorstep loans like Provident are alternative home collection loans offered by UK lenders, featuring flexible terms and no credit check options.

Provident, once the UK’s most popular doorstep lender, stopped offering loans in 2021. Since then, borrowers across the UK have been looking for similar lenders providing easy access to cash, quick approval, and in-person home collection services.

This guide explains the best Provident alternatives, no credit check options, city-specific lenders, eligibility requirements, and the pros and cons of doorstep loans in 2025.

What Happened to Provident?

Provident Financial was a major UK doorstep lender for decades but exited the high-cost credit market in 2021 due to:

Regulatory changes by the Financial Conduct Authority (FCA)

Rising customer complaints and compensation claims

A shift towards digital lending and online alternatives

As a result, borrowers who relied on home collection loans started searching for other doorstep lenders offering similar services.

Why Search for Doorstep Loans Like Provident?

Borrowers typically look for Provident alternatives because:

Simple application process: Minimal paperwork, often no guarantor needed.

Bad credit acceptance: Suitable for people with low or very bad credit scores.

Home collection model: Cash delivered and repayments collected at your door.

Local lender options: Some lenders offer city-specific doorstep loan services.

Best Doorstep Loan Companies Like Provident

Although Provident no longer operates, several UK lenders now offer similar home collection loans. Here are some top alternatives:

| Lender Name | Max Loan Amount | Repayment Term | Approval Time |

|---|---|---|---|

| Morses Club | £200 – £1,000 | 13–52 weeks | Same-day approval |

| Loans at Home | £100 – £600 | 14–34 weeks | Within 24 hours |

| Mutual Credit Union | £100 – £2,000 | Up to 24 months | 2–3 days |

| Greenwood Loans | £200 – £1,000 | 13–52 weeks | Same-day approval |

| Everyday Loans | £1,000 – £15,000 | 12–60 months | 1–3 days |

Tip: Always check if the lender is FCA-authorised before applying to ensure your rights and protections as a borrower.

Doorstep Loans Like Provident No Credit Check

Many borrowers search for doorstep loans with no credit check because of a poor credit history. Here’s what you need to know:

Soft checks only: Some lenders run soft credit checks that don’t affect your credit score.

Income verification: Approval depends more on your ability to repay than past defaults.

Direct lenders: Borrowers often prefer direct lenders for faster approval and fewer fees.

City-specific options: Some lenders operate locally, such as in Kent or Liverpool, offering more personalised service.

Important:Be cautious with lenders advertising no checks at all. Always confirm they are FCA-regulated to avoid illegal or predatory lenders.

City-Specific Doorstep Loan Alternatives

Some borrowers look for local doorstep lenders because they prefer in-person service or faster approval. Two common search areas include:

Doorstep Loans Like Provident in Kent UK:

Lenders such as Loans at Home and Morses Club often have agents serving towns across Kent, offering cash delivery and weekly repayment collection.Doorstep Loans Like Provident in Liverpool:

In Liverpool, several FCA-registered lenders provide home credit services, making it easier for borrowers with bad credit to access emergency funds.- 200 Pound Loan – Quick & Easy Cash Options in the UK

Local lenders may offer quicker response times and face-to-face support, making them ideal for borrowers who value personal service.

Eligibility Criteria & Documents

To qualify for doorstep loans like Provident, you typically need:

| Requirement | Details | Examples |

|---|---|---|

| Age | 18 or older | UK resident status required |

| Proof of Income | To ensure affordability | Payslips, bank statements |

| ID Verification | To confirm identity | Passport, driving licence |

| Proof of Address | To verify residency | Utility bill, council tax bill |

Some lenders may also require a bank account for record-keeping, even if cash loans are delivered in person.

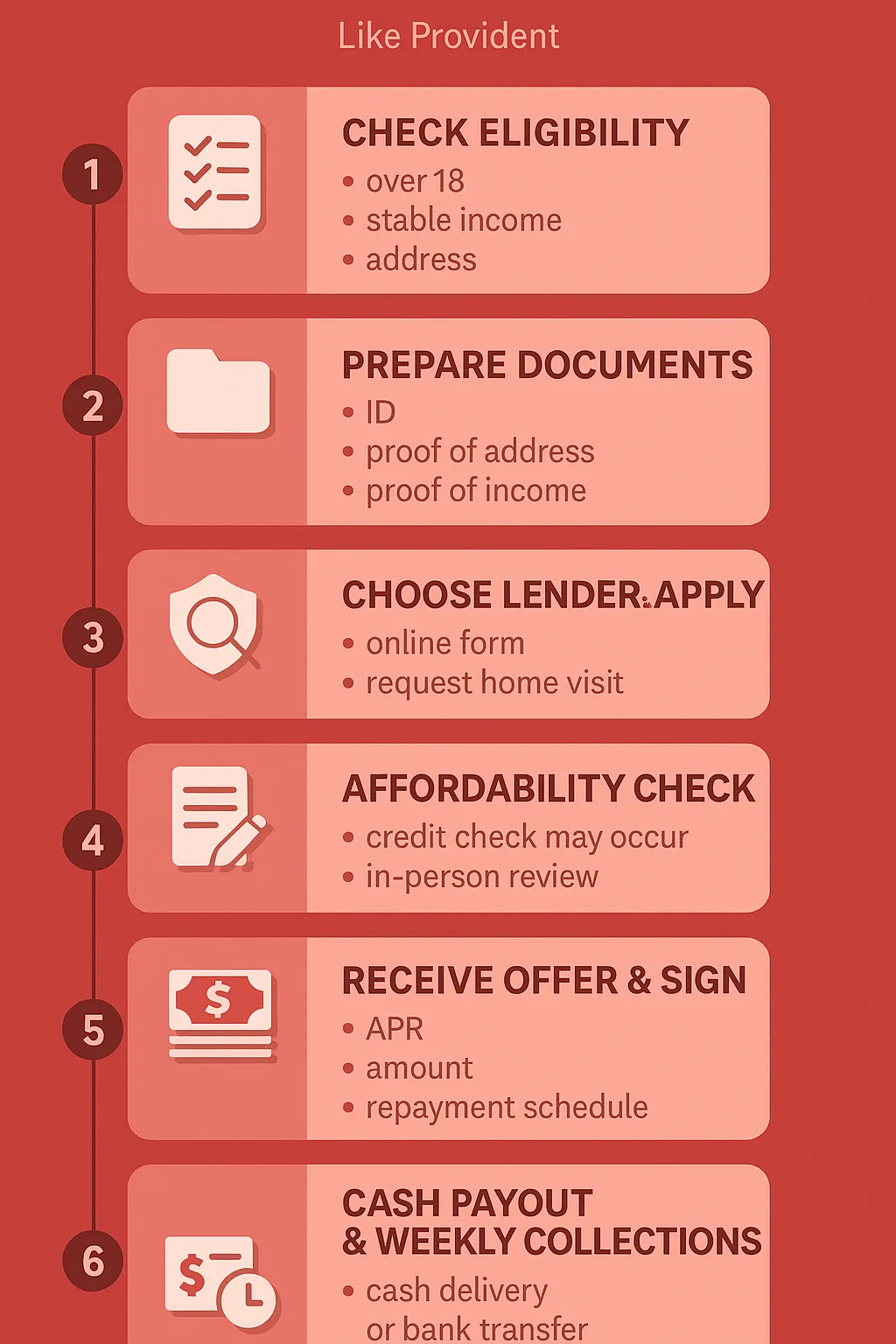

How to Apply for Doorstep Loans Like Provident (Step-by-Step)

Step 1: Research Lenders

Compare FCA-registered lenders offering doorstep loans in your area.

Step 2: Submit Application

Apply online, by phone, or request a home visit from a loan agent.

Step 3: Home Visit & Approval

A representative visits to verify documents and discuss loan terms.

Step 4: Receive Cash

Once approved, funds are handed over directly at your doorstep.

Step 5: Weekly Repayments

A collection agent visits on agreed dates to collect repayments in person.

Pros & Cons of Doorstep Loan Alternatives

| Pros | Cons |

|---|---|

| Accessible for borrowers with bad credit | Higher interest rates than mainstream loans |

| Home delivery & collection for convenience | Limited loan amounts for first-time borrowers |

| Fast approval, sometimes same-day | Weekly visits may feel intrusive |

| Local lenders offer personalised service | Risk of over-borrowing if not managed properly |

FAQs

Q1: Are doorstep loans like Provident safe? → Yes, if you borrow from FCA-authorised lenders following responsible lending rules.

Q2: Do doorstep loans require a credit check? → Some lenders perform soft checks only, while others focus on income verification.

Q3: Can I get doorstep loans in Kent or Liverpool? → Yes, several lenders provide local doorstep loan services in major UK cities.

Q4: Do I need a guarantor for doorstep loans? → No, most doorstep lenders do not require a guarantor for small to medium loan amounts.

Q5: How quickly can I get a doorstep loan? → Many lenders offer same-day approval and cash delivery if you meet eligibility criteria.