Open banking payday loans let lenders access your bank data securely, making approval faster and more accurate in the UK.

Open banking payday loans are a new generation of short-term credit where lenders use secure banking data sharing to check your affordability in real time. Instead of relying solely on credit scores or paper documents, lenders can view your verified income and spending patterns instantly through an FCA-regulated system. This means faster decisions, fairer assessments for borrowers with poor credit, and a smoother application process overall.

In this guide, we’ll explain exactly what open banking payday loans are, how they work, their main benefits and risks, and which UK lenders already use open banking technology to approve loans within hours.

What Is an Open Banking Payday Loan?

An open banking payday loan is a short-term loan where the lender uses open banking technology to verify your financial situation. By granting consent, you allow the lender to securely access your:

Recent income and salary deposits

Regular bills and expenses

Current account balance

This replaces traditional paper-based checks and speeds up the decision process. Open banking payday loans are ideal for borrowers who:

Have a bad credit history but steady income

Want a faster approval without sending documents

Need a secure, FCA-regulated system for data sharing

How Do Payday Loans with Open Banking Work?

The process is simple and usually completed in under an hour:

Apply online with a lender offering open banking.

Give consent for your bank to share transaction data via secure API.

Instant checks: The lender analyses your income, expenses, and repayment ability.

Approval: Decisions are often made within minutes.

Funds transfer: Approved loans are sent directly to your bank account the same day.

This streamlined approach reduces paperwork, improves accuracy, and helps lenders approve loans even when your credit score is low.

Benefits of Open Banking Payday Loans

Open banking payday loans are becoming increasingly popular in the UK because they offer several clear advantages over traditional payday lending:

Faster approval: Real-time access to your banking data means lenders can approve loans within minutes.

Better for bad credit: Even if your credit score is poor, affordability checks focus more on income and spending patterns.

More secure: Data is shared via FCA-regulated APIs, not through risky third parties.

- Provident Loans UK: How to Apply, Manage, and Repay Your Loan

Transparent decisions: Borrowers can clearly see why a loan was approved or declined.

Convenience: No need to upload payslips, bank statements, or extra paperwork.

👉 These benefits make open banking payday loans attractive for borrowers seeking speed, security, and accessibility.

Payday Loans That Use Open Banking (UK Examples)

Several UK payday lenders already use open banking technology to process applications faster and more securely. Examples include:

| Lender | Max Loan | Approval Time | Repayment |

|---|---|---|---|

| Sunny Loans | £100 – £1,000 | Within 15 minutes | 1–3 months |

| Mr Lender | £200 – £1,000 | Same-day approval | Weekly / Monthly |

| Satsuma Loans | £100 – £1,000 | Within 24 hours | Flexible instalments |

| Drafty | £200 – £3,000 | Instant decision | Revolving credit |

⚠️ Tip: Always confirm that the lender is FCA-authorised before applying. This ensures your data is protected and the loan terms are legally compliant.

Payday Loan No Open Banking – Is It Possible?

Not all lenders in the UK require open banking for payday loans. Some still accept traditional application methods, which may suit borrowers who are uncomfortable sharing banking data. These lenders typically ask for:

Paper documents such as payslips or bank statements

Employment details to verify income

Credit checks that may be more strict than open banking lenders

👉 While it’s still possible to get a payday loan without open banking, the process is usually slower and may involve stricter checks. Borrowers who want instant approval often find open banking the easier route.

Risks & Considerations

Although open banking payday loans are faster and more transparent, borrowers should be aware of potential risks:

Data privacy concerns: Some people are uncomfortable granting access to their bank data.

Over-borrowing risk: Faster approval can encourage borrowing more than you can repay.

High APRs remain: Despite the technology, payday loans are still high-cost credit products.

Dependence on technology: If your bank or lender has technical issues, approval may be delayed.

⚠️ Important: Always borrow responsibly. Open banking makes payday loans quicker, but it does not change the high interest rates or risks associated with short-term borrowing.

Eligibility & Requirements

To apply for an open banking payday loan in the UK, you’ll usually need to meet the following criteria:

| Requirement | Details |

|---|---|

| Age | Must be at least 18 years old |

| Residency | UK resident with a valid address |

| Proof of Income | Regular income from employment or benefits |

| Bank Account | Active UK bank account with online banking access |

| Consent | Willingness to share data through open banking |

👉 Without online banking access, you cannot apply for an open banking payday loan, since the system relies on real-time data.

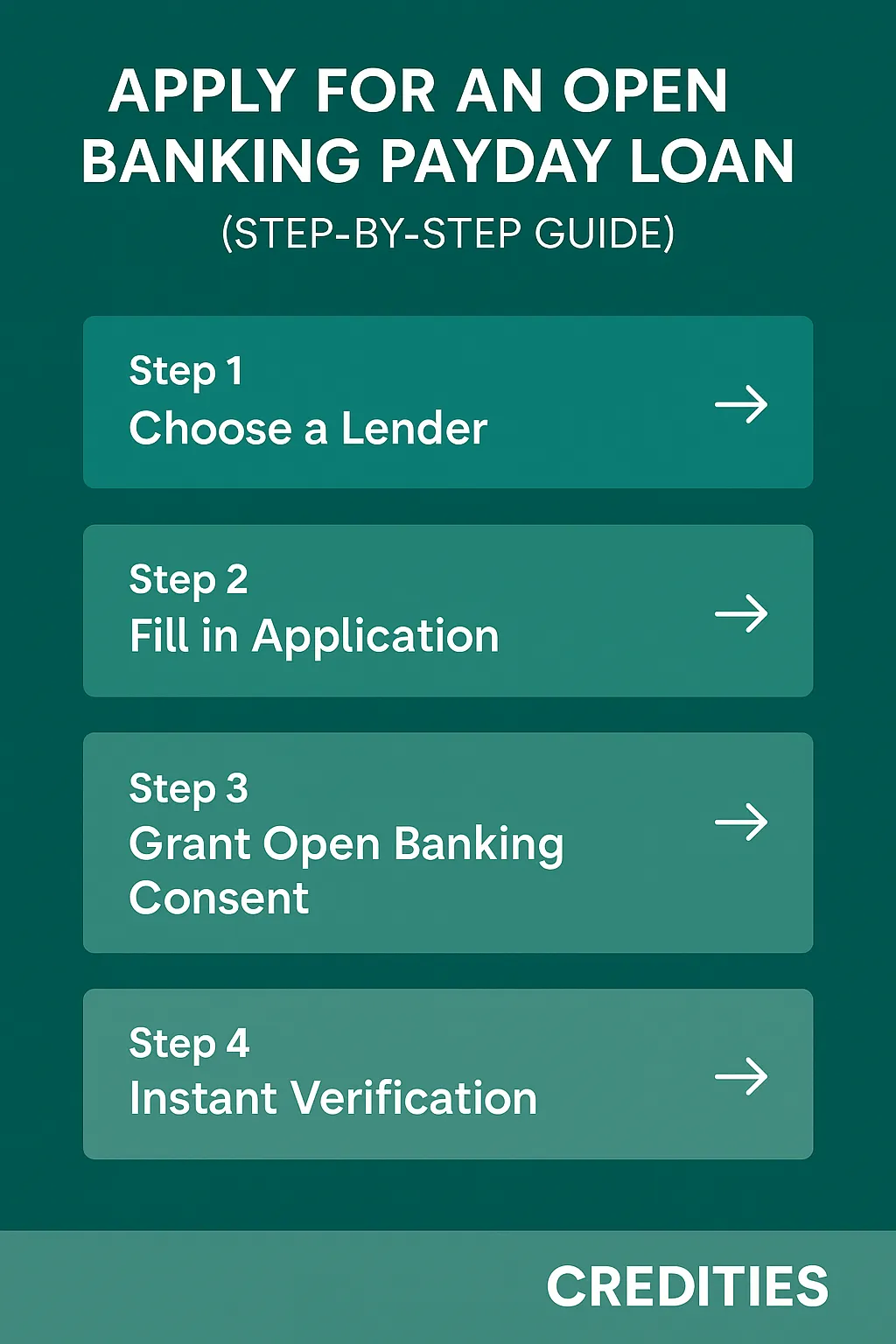

How to Apply for an Open Banking Payday Loan (Step-by-Step Guide)

Step 1: Choose a Lender → Compare FCA-authorised payday lenders that use open banking technology.

Step 2: Fill in Application → Provide your personal details (name, address, employment, and loan amount needed).

Step 3: Grant Open Banking Consent → You’ll be redirected to your bank’s secure portal to approve data sharing.

Step 4: Instant Verification → The lender analyses your income and expenses in real time.

Step 5: Receive Funds → If approved, money is usually transferred to your account within minutes to a few hours.

Pros & Cons of Open Banking Payday Loans

| Pros | Cons |

|---|---|

| Faster approval thanks to instant income checks | Data sharing may concern privacy-conscious borrowers |

| Accessible even with bad credit if income is steady | Still high-cost credit with high APRs |

| No paperwork – no need to upload payslips or bills | Not all lenders support open banking |

| Secure FCA-regulated system for bank data sharing | Requires online banking access |

| Transparent decisions based on real-time affordability | Risk of over-borrowing due to speed |

Alternatives to Payday Loans with Open Banking

If an open banking payday loan isn’t the right fit, consider these safer or cheaper alternatives:

Credit Unions – Community lenders with fairer interest rates and flexible repayment plans.

- Doorstep Loans Like Provident – Best Alternatives & No Credit Check Options

Instalment Loans – Spread repayments over 3–12 months instead of one payday.

Salary Advance Apps – Some UK employers and apps offer access to earned wages early.

Bank Overdrafts – Arranged overdrafts may be more cost-effective for short-term borrowing.

Government Support – In some cases, local councils provide hardship funds for emergencies.