A beneficiary loan in New Zealand is a small personal loan designed for people who receive WINZ or government benefits. It allows beneficiaries to borrow short-term money to cover essential or unexpected expenses, such as rent, bills, or medical costs — even if they have bad credit or limited income.

These loans are typically offered by licensed lenders who assess your current affordability, not your credit score, making them accessible for people on Jobseeker, Sole Parent, or Disability Benefits.

| No Credit Check Loans for Beneficiaries in NZ |

| Urgent No Credit Check Loans for Beneficiaries NZ |

| Loans for Bad Credit in New Zealand |

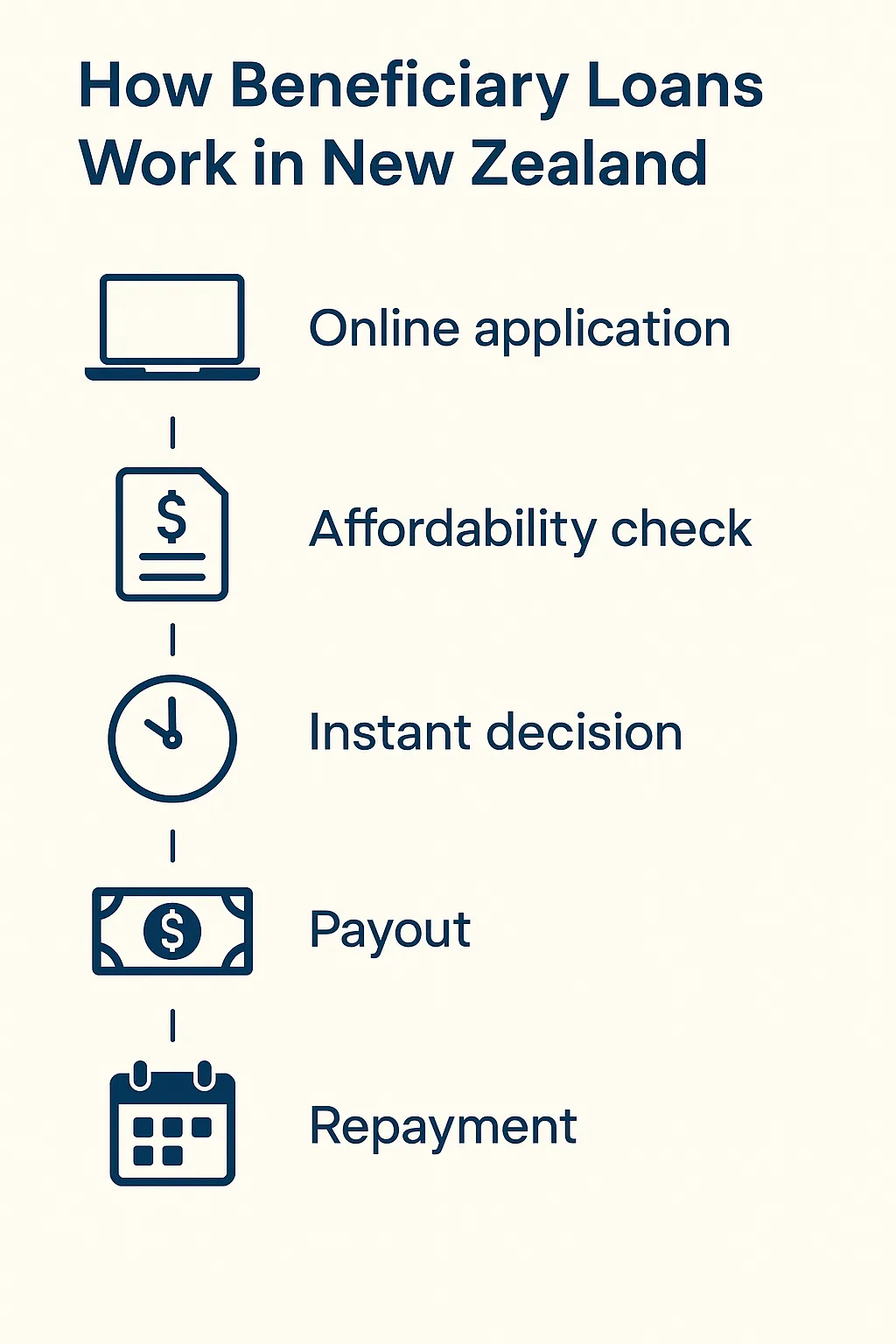

How Beneficiary Loans Work in New Zealand

A beneficiary loan works like a short-term personal loan tailored for people receiving WINZ or other government payments. Unlike standard bank credit, these loans are based on current income, not past credit history, and are designed to provide quick access to cash when expenses can’t wait until the next benefit cycle.

How it works – Step by step

Online application: You fill in an online form with ID and bank-statement access (to verify WINZ payments).

Affordability check: The lender reviews your recent income and expenses instead of running a hard credit report.

Instant decision: Many systems approve or decline automatically within minutes.

Payout: Funds are transferred to your NZ bank account, often the same day if approved before 3 PM.

Repayment: Payments are deducted weekly or fortnightly to match your benefit schedule.

Typical loan structure

| Loan Type | Amount Range | Term | Notes |

|---|---|---|---|

| Beneficiary loan | $300 – $2 000 NZD | 4–24 weeks | Repayable in small instalments via automatic debit |

Most lenders charge a flat fee or interest rate between 15–25 % per month. Though these rates look high, the loans are short and intended for emergency use — not long-term borrowing.

💡Tip: The safest approach is to use beneficiary loans only for urgent, essential expenses, and repay as soon as possible to avoid rollover fees.

Where Can I Apply for a Beneficiary Loan in New Zealand?

Finding a safe and reliable place to apply for a beneficiary loan in NZ is just as important as getting fast approval. Below are the most common options, from government programs to private licensed lenders that accept beneficiaries and low-income earners.

1. WINZ Advance Payment or Special Needs Grant

If you already receive a Work and Income (WINZ) benefit, this should be your first step.

WINZ offers:

- Advance Payments of Benefit – an early payment of your future benefit (repayable over time).

- Special Needs Grants – one-off assistance for essential costs (non-repayable).

✅ Best for: Urgent needs like rent, food, or medical costs

✅ Interest: 0% (no fees or charges)

✅ Apply via: workandincome.govt.nz

2. Good Shepherd NZ – No Interest Loans (NILS)

Good Shepherd NZ, supported by BNZ and MSD, provides No Interest Loans up to $2,000 NZD for essentials such as appliances, education, or healthcare. You don’t need perfect credit — only stable benefit income and affordability proof.

✅ Best for: Beneficiaries wanting an ethical, non-profit option

✅ Interest: 0% interest, no fees

✅ Apply via: goodshepherd.org.nz

3. Licensed Private Lenders (Urgent Cash Providers)

If you need money the same day, several FSPR-registered lenders in New Zealand offer fast no credit check loans for beneficiaries:

Moola – from $500 to $5,000

Savvy Loans – from $300 to $2,000

Cashburst – same-day approval up to $1,500

Nodifi Finance – from $1,000 to $7,000

These companies focus on affordability, not your credit score, and typically verify income directly from your bank account.

💡 Tip: Always check that your lender is listed on the official FSP Register. Avoid any lender that asks for upfront fees.

4. Community Finance & Charities

Other safe options include Salvation Army, Ngā Tangata Microfinance, and local Budgeting Services.

They provide low-cost or no-interest loans and financial mentoring for people struggling with debt.

🔎 In summary:Start with WINZ or Good Shepherd for low-cost help. If you need money immediately and understand the costs, compare offers from licensed lenders that support beneficiaries.

Frequently Asked Questions About Beneficiary Loans in New Zealand

What’s the meaning of a beneficiary loan in New Zealand?

A beneficiary loan is a short-term personal loan offered to people receiving WINZ or government benefits. It helps cover urgent costs like rent, bills, or medical expenses. If the borrower has bad credit check: bad credit loans for beneficiaries in NZ.

Can a beneficiary get a loan in New Zealand?

✅ Yes. Many licensed lenders in NZ accept benefit income as proof of affordability. As long as you have regular WINZ payments and a valid NZ bank account, you may qualify for a small urgent loan.

How fast can a beneficiary receive an urgent loan?

Most lenders provide same-day approval and payout if you apply before 3 PM on a business day. Applications made late in the day or on weekends are processed the next working day.

Can a beneficiary get a home loan in NZ?

It’s rare but possible. Kainga Ora’s First Home Loan and some credit unions can consider part-time income or benefit income if supported by savings or a guarantor.

Can beneficiaries get a loan of $10 000 in NZ?

Yes, but only from a few larger lenders like Nectar NZ or Nodifi Finance. They usually require proof of stable income and good repayment behaviour; terms often range between 6 and 24 months.

What are safer alternatives to urgent loans for beneficiaries?

Beneficiaries can apply for WINZ Advance Payments, Good Shepherd NILS loans, or Salvation Army community finance options — all of which have no interest and no hidden fees.