Getting car finance with bad credit can feel impossible — especially if you’re a beneficiary in New Zealand living on a WINZ income. But the good news is, it’s still possible.

Several licensed NZ lenders offer car loans for beneficiaries, focusing on your current affordability instead of your credit history.

| Car Loans for Bad Credit in New Zealand |

| No Credit Check Loans for Beneficiaries in NZ |

| Urgent No Credit Check Loans for Beneficiaries NZ |

These car finance options help you buy a reliable vehicle for work, study, or family needs, even when banks say no. In this guide, we’ll explain how car finance for beneficiaries works, which lenders accept WINZ income, and what you can do to increase your approval chances.

Can You Get Car Finance on a Benefit in NZ?

Yes, you can get car finance while on a benefit in New Zealand — even if you have bad credit. Many lenders now look at your current income and spending habits, not just your credit history. If you receive a steady WINZ payment and can show you can afford repayments, you may qualify for a small or mid-range car loan.

Most non-bank and community lenders offer flexible car finance options for beneficiaries. Instead of a full credit check, they use an affordability assessment that reviews your bank transactions from the past 90 days. This helps prove you can handle repayments responsibly.

What Lenders Usually Look For

- Regular WINZ or benefit income

- Valid NZ driver licence and ID

- Active New Zealand bank account

- Proof of residence (rental agreement or utility bill)

- Clean record of recent repayments (even small bills)

In short: if your benefit income is consistent and your expenses are manageable, you can still get approved for car finance — though you might start with a smaller loan limit or higher interest rate.

How Car Finance Works for Beneficiaries with Bad Credit

Even if your credit history isn’t perfect, you can still get car finance in New Zealand as a beneficiary. Instead of relying on your credit score, most lenders use an affordability check, reviewing your current income and bank statements to see if you can manage regular repayments.

This system makes it possible to qualify for secured or unsecured car loans, even when traditional banks would decline your application.

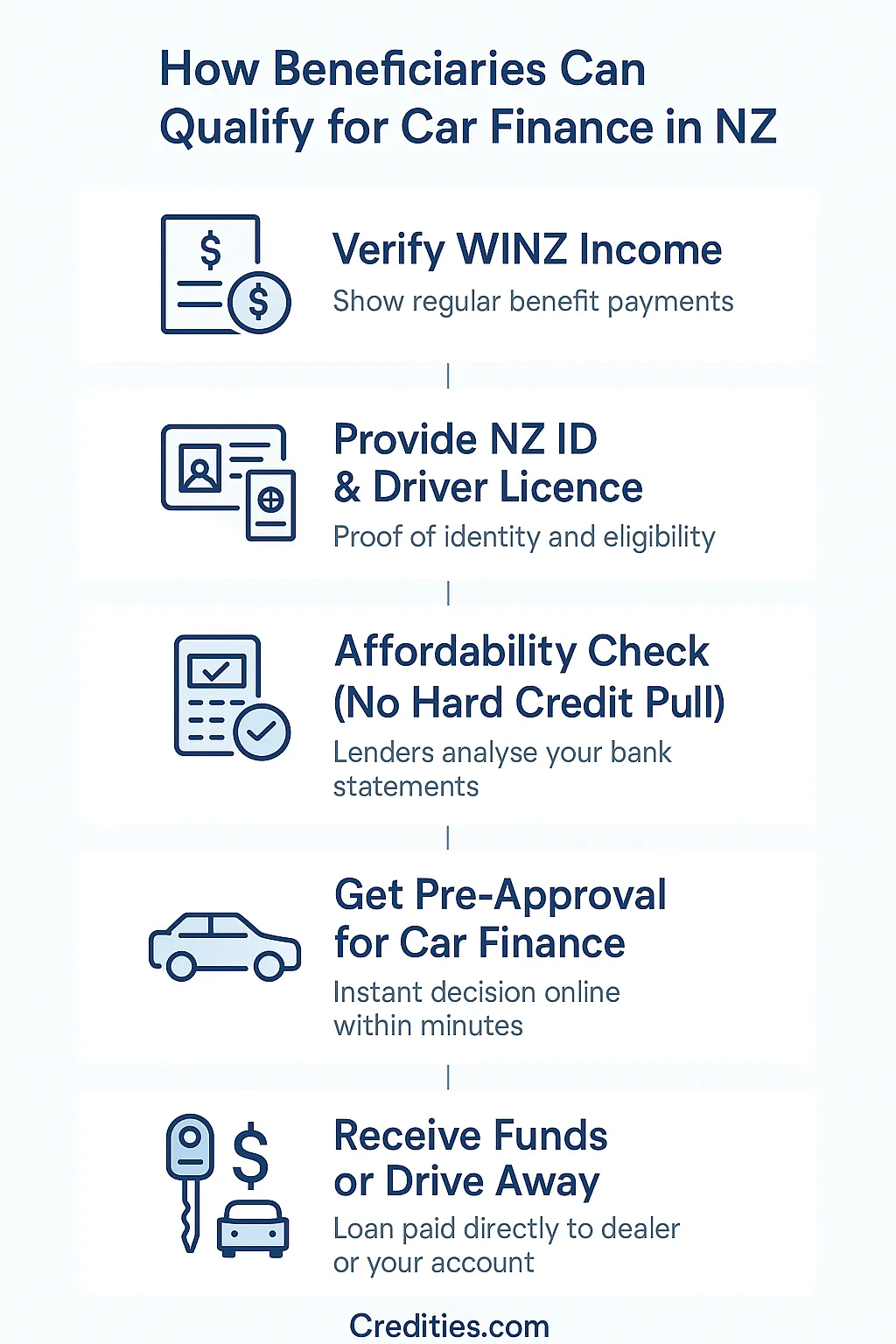

How the Process Works

Apply online with your NZ ID, driver licence, and bank statement access (to confirm WINZ payments).

Lender reviews affordability instead of running a hard credit check.

Instant decision — many platforms approve within 30–60 minutes.

Loan paid directly to the car dealer or your account.

Repay weekly or fortnightly through automatic deductions.

Typical Car Finance Terms for Beneficiaries

| Loan Type | Amount Range | Term | Interest Rate |

|---|---|---|---|

| Secured car loan | $2,000 – $10,000 NZD | 6–36 months | 10% – 25% p.a. |

| Unsecured car loan | $500 – $3,000 NZD | 3–12 months | 20% – 35% p.a. |

Rates vary depending on your income, vehicle age, and lender’s risk policy.

Pro Tip: If your credit history includes defaults, choose lenders that offer “second chance car finance” or “soft check approval.” These lenders often partner with beneficiary-focused programs and consider stable WINZ income as sufficient proof of reliability.

Trusted Lenders Offering Car Finance for Beneficiaries in NZ

Finding a trustworthy lender is crucial when applying for car finance as a beneficiary in New Zealand. While traditional banks rarely approve loans based only on WINZ or benefit income, several licensed car finance companies now provide flexible options for people with bad credit or low income.

Below are a few verified lenders that publicly accept applications from beneficiaries — but always review the full terms before applying.

1. Sterling Cars (Auckland)

Sterling Cars offers WINZ-approved car finance with no deposit required and flexible repayment plans.

They specifically mention support for beneficiaries and people with bad credit, focusing on affordability checks rather than strict credit scores.

💰 Loan amount: from $2,000 to $10,000 NZD

⏱ Approval time: usually within 24 hours

⚠ Note: Always confirm interest rates and read the Responsible Lending Code conditions before signing.

sterlingcars.co.nz

2. CarPow

CarPow provides online car finance for customers with bad credit, defaults, or WINZ income.

Their system evaluates real-time bank data instead of traditional credit reports.

💰 Loan range: typically $1,000 – $8,000 NZD

💻 100 % online application, fast pre-approval

⚠ Note: “Beneficiaries considered” doesn’t guarantee approval; affordability proof is still required.

carpow.co.nz

3. Genuine Vehicle Imports (GVI)

GVI promotes “Beneficiaries Finance – Yes We Can” on its finance page.

They specialise in second-hand car sales with in-house finance options, including for those with discharged bankruptcy or bad credit history.

💰 Loan range: variable depending on vehicle

🏦 In-house approval system, same-day decisions

⚠ Note: Vehicle age, mileage, and deposit amount may affect eligibility.

gvi.kiwi

4. 2 Cheap Cars

This well-known NZ dealership includes beneficiary applications in its finance form.

They work with multiple lenders to offer both secured and unsecured car loans based on benefit income.

💰 Loan range: $1,000 – $15,000 NZD

💡 Accepts WINZ income proof

⚠ Note: Some lenders may require co-signer support or proof of residence.

2cheapcars.co.nz

5. Good Shepherd NZ – No Interest Loans (NILS)

In partnership with BNZ and MSD, Good Shepherd NZ provides no-interest loans (up to $2,000 NZD) that can also be used for essential car purchases or repairs.

💰 Amount: up to $2,000 NZD

💲 0 % interest, no hidden fees

⚠ Note: You must be on a benefit or low income, and the process takes longer than private lenders.

goodshepherd.org.nz

Before You Apply

Always compare total repayment cost, not just interest rates.

Some lenders advertising “beneficiary car finance” may still charge high establishment or brokerage fees.

To protect yourself:

Check lender registration via the Financial Service Providers Register.

Read the Responsible Lending Code.

Never pay upfront “application” or “broker” fees.

In summary: Beneficiaries in NZ can access car finance through legitimate lenders, but success depends on affordability, income stability, and vehicle value — not simply benefit status.

WINZ-approved Car Finance

WINZ-approved car finance refers to vehicle loans in New Zealand that are accepted or funded through the Work and Income New Zealand (WINZ) system — part of the Ministry of Social Development (MSD). These are not traditional bank loans but government-assisted financing options designed for people on low income or receiving benefits.

A WINZ-approved car finance means:

- The loan or car purchase has been approved by WINZ/MSD as a “Recoverable Assistance Payment” or “Advances on Benefit”.

- WINZ agrees that the car is essential for work, study, or family needs (e.g. getting to job interviews, transporting children).

- The payment is interest-free and repaid gradually through small weekly deductions from your benefit.

What It Can Be Used For

WINZ may approve funding for:

- Buying a used car (reasonable cost and condition only)

- Vehicle repairs or registration

- Car insurance (basic cover)

- Driver licensing fees

Eligibility

To qualify, you generally must:

- Be receiving a benefit or low income support (e.g. Jobseeker, Sole Parent, Disability, or Supported Living Payment)

- Prove the car is necessary for daily life or employment

- Have no other reasonable transport options

- Show that the loan is affordable within your current benefit

How It’s Paid

- WINZ pays the car dealer or seller directly (not you)

- You repay WINZ weekly or fortnightly from your benefit

- There’s no interest, but you must repay the full amount

Limits & Restrictions

- The car must be reasonably priced (typically under NZD 6,000–8,000)

- WINZ won’t approve luxury or non-essential vehicles

- You cannot already have too many active WINZ advances

Example: WINZ-approved car finance:

If you’re on a Sole Parent Support benefit and need a car to take your child to school and travel to part-time work, you can apply for a WINZ advance of, say, $5,000. WINZ pays the car dealer directly and deducts $35 per week from your benefit until it’s fully repaid — all interest-free.

Frequently Asked Questions About Car Finance for Beneficiaries in NZ

Can I get car finance while on a benefit in NZ?

Yes. Several lenders such as Sterling Cars, CarPow, and GVI offer car loans to beneficiaries. They base approval on your current income and affordability, not only your credit score.

Can I get car finance with bad credit in NZ?

Yes, many non-bank lenders in NZ accept bad credit applicants. They use soft credit checks and affordability reviews instead of full credit reports.

Can WINZ help me buy a car?

WINZ doesn’t offer traditional car loans but can provide Advance Payments or refer you to Good Shepherd NZ’s no-interest loans for essential vehicle needs.

How much can I borrow for car finance as a beneficiary?

Most lenders offer between $2,000 and $10,000 NZD, depending on your income, expenses, and vehicle type.

What’s the safest way to apply for car finance?

Apply only with FSPR-registered lenders, read the Responsible Lending Code, and avoid anyone requesting upfront fees.

Conclusion

Getting car finance as a beneficiary in New Zealand is absolutely possible — even with bad credit. The key is to work with trusted, licensed lenders that assess your real income and expenses rather than relying solely on credit reports.

If you have a regular WINZ payment and can show stable affordability, you stand a genuine chance of approval. Start with ethical options such as Good Shepherd NZ or Sterling Cars, compare total repayment costs, and always borrow responsibly.

💬 In short: Car finance for beneficiaries in NZ isn’t a myth — it’s a realistic path to mobility, provided you choose wisely and stay within your means.