Fast approval loans for beneficiaries in New Zealand are short-term financial solutions designed for people receiving WINZ or government support. These loans make it possible to access quick cash when unexpected costs appear — without the long wait times or strict credit checks of traditional banks.

Most lenders offer unsecured loans for beneficiaries, meaning no assets or guarantors are required. Depending on your situation, you can also find fast cash loans, easy loans, payday loans, or instant small loans for beneficiaries — all processed online and approved within hours.

Even if you have a bad credit history, many licensed NZ lenders focus on your current income, not your past score. This makes fast approval loans one of the most accessible options for beneficiaries needing urgent financial help.

Details on how to apply for these loans, eligibility requirements, and trusted lenders are explained below.

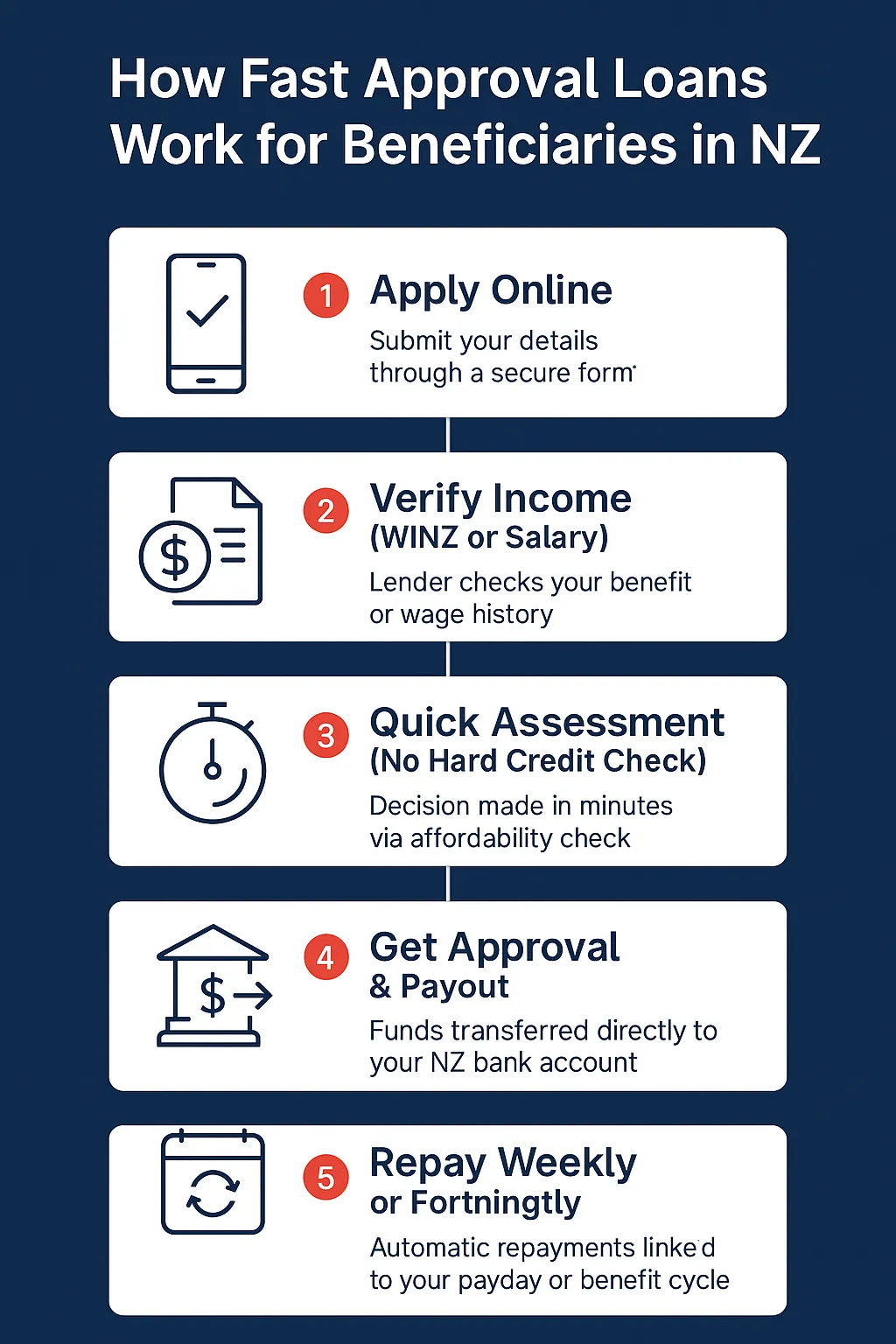

How Fast Approval Loans Work for Beneficiaries in NZ

Fast approval loans are designed to provide quick access to money — usually within the same day. You apply online, verify your income (such as WINZ payments), and once approved, funds are deposited directly into your bank account.

| Loan Type | Typical Amount | Payout Time |

|---|---|---|

| Fast cash loans for beneficiaries | $200 – $1,500 | 30–60 mins |

| Unsecured loans for beneficiaries | $500 – $5,000 | Same day |

| Payday loans for beneficiaries | $100 – $1,000 | Instant approval |

| Small loans for beneficiaries | $200 – $2,000 | Within 24 hrs |

💡 Most lenders don’t require collateral — they assess your affordability through your bank statements.

Where to Apply for Fast Approval Loans for Beneficiaries in NZ

Several trusted lenders in New Zealand offer fast approval loans for beneficiaries with same-day payment options. These platforms are 100% online, quick, and designed for people receiving WINZ or other benefits.

| Lender | Loan Range | Approval Speed | Features |

|---|---|---|---|

| Moola | $500 – $5,000 | Within 1 hour | No paperwork, instant approval |

| Cashburst | $200 – $1,500 | 30–60 mins | Works with WINZ, soft credit check |

| Savvy Loans | $300 – $2,000 | Same day | Easy online form, no guarantor |

| QuickCash NZ | $500 – $5,000 | 24 hrs | 24/7 applications, flexible repayment |

💡 Note: Always verify that the lender is FSPR-registered before sharing personal details.

Low-Interest Alternatives

If you prefer safer or interest-free options:

Good Shepherd NZ (NILS) – up to $2,000, 0% interest

WINZ Advance Payment – small advance from your benefit

Salvation Army / Ngā Tangata Microfinance – community-based support loans

Fast Cash Loans for Beneficiaries NZ

Fast cash loans give beneficiaries quick access to money within hours — no need to wait for bank approval. These are usually short-term loans between $200 and $1,500, perfect for urgent bills or emergency expenses.

Unsecured Loans for Beneficiaries NZ

With unsecured loans, you don’t need to provide a car, house, or guarantor as security. Lenders simply review your income and affordability through your bank statements, making it ideal for beneficiaries with limited assets.

Payday Loans for Beneficiaries NZ

Payday loans are small, fast loans linked to your next benefit or wage payment. They are often approved instantly and repaid automatically when your next payment arrives — perfect for short-term needs.

Easy Loans for Beneficiaries NZ

Easy loans focus on simple applications and quick decisions. Most NZ lenders offer a 2–5 minute online form and use open banking to verify income, so there’s no paperwork or in-person visit required.

Instant Loans for Beneficiaries

Instant loans mean same-hour approval and payout. If you apply during business hours with verified bank data, funds can appear in your account within 60 minutes — even for bad credit applicants.

Small Loans for Beneficiaries NZ

For smaller needs like groceries, school costs, or car repairs, small loans for beneficiaries offer $200–$2,000 NZD with short repayment terms. Some community lenders even provide interest-free options through NILS or WINZ advance programs.

Frequently Asked Questions About Fast Approval Loans for Beneficiaries NZ

Can beneficiaries get fast approval loans in NZ? → Yes. Many licensed lenders in NZ offer fast approval loans for beneficiaries, often with same-day or 1-hour payouts.

Are these loans available with bad credit? → Yes. Bad credit is not a barrier if you can prove stable income or WINZ payments. Lenders focus on affordability, not your score.

Do I need security or a guarantor? → No. These are unsecured loans, so you don’t need to provide a car, house, or co-signer.

How much can I borrow as a beneficiary? → You can typically borrow $200 to $5,000 NZD, depending on your income, expenses, and repayment history.

Are there safer or low-interest alternatives? → Yes — Good Shepherd NZ (NILS) and WINZ Advance Payments offer interest-free options for essential expenses.

Conclusion

Fast approval loans for beneficiaries in New Zealand provide a lifeline for those needing urgent cash — often within hours. Whether it’s a fast cash, payday, or unsecured loan, most NZ lenders make it possible to apply online, get approved instantly, and receive funds the same day.

However, short-term loans should always be used responsibly. Compare lenders carefully, confirm they’re FSPR-registered, and never borrow more than you can repay. For essential needs, explore Good Shepherd NZ’s no-interest loans or WINZ Advance Payments — safer and long-term options.

💬 In summary: Fast approval loans can be a quick solution for beneficiaries, but smart choices keep your finances secure.