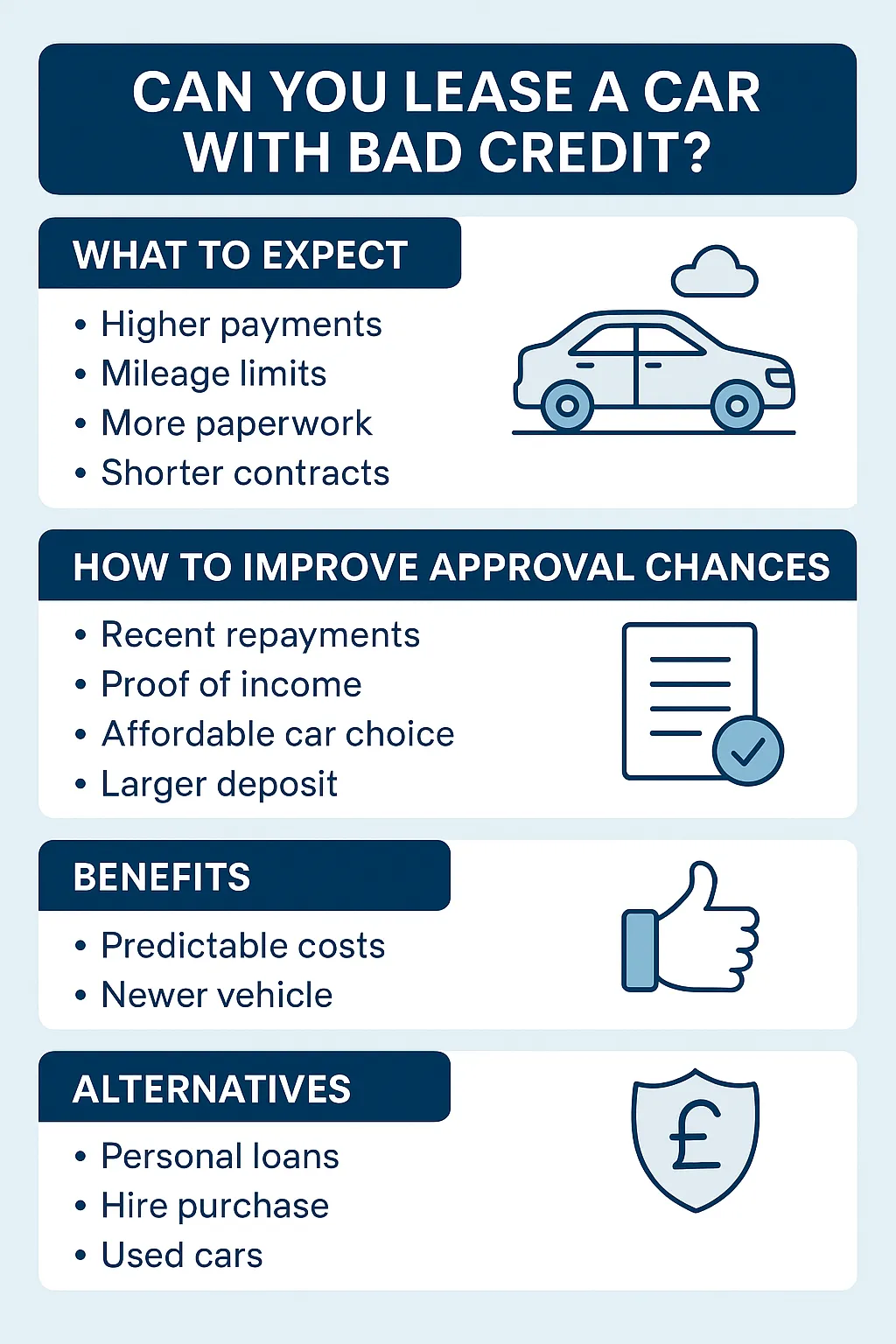

Yes — you can lease a car with bad credit, but you’ll face tighter checks, potentially higher monthly rentals, and, in some cases, a larger upfront payment.

Leasing providers assess affordability first, then risk. If your credit file shows missed payments or defaults, you may still be approved by specialist brokers or funders that work with higher-risk applicants. Expect stricter terms (shorter contracts, mileage limits, or a refundable security), and be prepared to evidence stable income.

Comparing offers and tidying up your file (e.g., correcting errors, clearing small balances) can noticeably improve your chances.

Can You Lease a Car with Bad Credit History?

A bad credit history doesn’t automatically disqualify you. Most lessors weigh three things: affordability, stability, and risk mitigation. If you can show predictable income and manageable outgoings, many specialist providers will consider you.

What typically helps

Recent on-time payments and no active CCJs

Proof of employment or regular self-employed income

Lower-risk choices (modest car, lower mileage, shorter term)

Willingness to pay a higher initial rental or provide a refundable security

What to expect

Higher monthly rentals than prime customers

Tighter mileage caps and stricter wear-and-tear clauses

More documentation (ID, proof of address, bank statements, payslips or SA302s)

Best for: Drivers who can afford a sensible monthly budget and need predictable motoring costs without owning the car.

Can Bad Credit Lease a Car?

In plain terms, yes — bad credit can lease a car when the deal is structured carefully.

How it usually works

Pick a realistic vehicle class to keep rentals affordable.

Choose shorter terms (e.g., 24–36 months) to reduce lender risk.

Offer a higher initial rental to lower monthly outgoings and improve acceptance.

Provide clear paperwork: recent bank statements, payslips, proof of address, driving licence.

Pros

Fixed monthly budgeting, road-tax included on most contracts

Newer, reliable cars with warranty coverage

Cons

Costlier than prime leasing; fewer model choices

Missed payments can harm your credit further

Bad Credit Lease Car

This term usually describes leasing offers tailored to applicants with a poor credit profile.

Typical features include:

Higher initial rental or security deposit requirements

Limited car model selection, often focusing on smaller or older vehicles

Shorter lease terms (12–36 months) to reduce lender exposure

Why people choose it:

Predictable monthly costs without car ownership obligations

Access to newer vehicles despite previous credit challenges

Key tip: Compare at least three bad credit leasing specialists to ensure you get the most competitive deal available.

Car Lease Bad Credit

When searching for “car lease bad credit” options in the UK, you’ll find two main provider types:

Mainstream funders – usually require clean credit files

Specialist brokers/lenders – designed for people with defaults, CCJs, or missed payments

Sample Table: UK Bad Credit Leasing Providers

| Provider Type | Min. Credit Score | Typical Deposit | Contract Length |

|---|---|---|---|

| Mainstream Lenders | 700+ | 3–6 months rental | 24–48 months |

| Specialist Lenders | 500+ | 1–3 months rental | 12–36 months |

Car on Lease Bad Credit

Leasing a car with bad credit typically involves online pre-approval before a formal credit check:

Process Overview:

Complete a short online form with personal details and budget preferences

Upload income evidence and proof of address

Receive a soft-search eligibility check to avoid damaging your score

Get matched with suitable vehicles and rental terms

Average approval times: 24–72 hours if documents are complete and upfront payments are available.

Leasing Vehicles with Bad Credit

It’s not limited to cars — vans, SUVs, and even electric vehicles can be leased with bad credit.

For businesses:

Some lenders specialise in fleet leasing for small companies with imperfect credit histories.

Income stability, VAT registration, and trading history often matter more than personal credit scores.

For individuals:

Non-car options (e.g., vans) often carry higher insurance and rental rates due to larger vehicle sizes.

Car Without Credit Check

True no credit check car leasing is rare in the UK. Most legitimate lenders run at least a soft search for identity and affordability checks.

Risks of so-called “no check” deals:

May involve unregulated lenders → higher risk of unfair terms

Often require large deposits or full up-front payments

Limited consumer protections compared to FCA-regulated agreements

Recommendation: Always ensure the provider is FCA-regulated and listed on the Financial Services Register.

Bad Credit Lease Cars No Deposit

Some UK providers advertise “no deposit” car leases for bad credit applicants, but conditions usually apply:

Monthly rentals may be significantly higher

Only certain car models or used vehicles qualify

Applicants must prove strong income stability

Who benefits most?

Drivers without upfront savings but with reliable income streams

Those looking for flexible, short-term arrangements

Key tip: Always compare the total cost over the entire contract, not just the monthly rental.

No Deposit Bad Credit Lease Cars

This phrase is often used interchangeably but usually means:

Zero initial rental at signing

Payments spread evenly across the term

Eligibility checks still apply, so it’s not a free-pass option

Important: Watch out for admin fees, excess mileage charges, and early termination penalties.

Alternatives to Leasing with Bad Credit

If leasing isn’t suitable or too expensive, consider these alternatives:

Personal Contract Purchase (PCP): Offers ownership at the end of term with flexible monthly payments.

Hire Purchase (HP): Higher acceptance rates, fixed payments, and ownership once final payment clears.

Car Subscription Services: Month-to-month access with insurance and tax included.

Buying Used Cars Outright: Avoids finance altogether if you can save gradually.

FAQs

Q1: Is it easier to lease or buy a car with bad credit? → Leasing can be easier because lenders focus on affordability rather than full ownership risk.

Q2: What credit score is needed for car leasing? → Specialist lenders may approve scores as low as 500, but terms improve above 650.

Q3: Do all bad credit leases require deposits? → No, some zero-deposit options exist, but they often have higher monthly costs.

Q4: Can I improve my approval chances? → Yes — pay off small debts, register on the electoral roll, and provide stable income evidence.

Q5: Are no credit check car leases legitimate? → Very few are fully legitimate; always confirm FCA regulation and read the fine print.