A Christmas loan is a short-term personal loan designed to help New Zealanders manage extra expenses during the festive season — from Christmas shopping and gift buying to travel, food, and living costs over the holidays.

Many people turn to Christmas loans NZ or even benefit loans for Christmas when their income isn’t enough to cover holiday spending. These loans are often available from both direct lenders and credit unions, making them accessible even for those with bad credit or irregular employment.

Unlike standard personal loans, Christmas loans are typically short term, with smaller amounts ranging between NZ $300 – NZ $3,000, and faster approval times. Some providers even offer Christmas loans no credit check, allowing applicants with a low credit score or no credit history to apply online and receive funds instantly, sometimes within the same day.

If you need a cash loan for Christmas or want to ease your living costs over Christmas, these seasonal financing options can be a convenient way to spread the expenses across several months.

Christmas Loan Limits, Interest Rates and Repayment Terms

When applying for Christmas loans NZ, the amount you can borrow and the repayment terms depend on your credit profile and lender type. Most short term Christmas loans in New Zealand range between NZ $300 and NZ $3,000, typically repaid within 3 to 12 months.

Interest rates also vary depending on whether you choose a credit union Christmas loan or one from direct lenders.

- Credit unions usually offer lower interest (10 – 15% p.a.) with flexible repayment plans.

- Online direct lenders providing Christmas cash fast loan or instant Christmas loans tend to charge higher rates (20 – 35% p.a.) but approve applications within hours.

Here’s an overview 👇

| Loan Type | Loan Amount (NZD) | Term | Average Interest (p.a.) |

|---|---|---|---|

| Standard Christmas Loan | 500 – 3,000 | 3 – 12 months | 12% – 25% |

| No Credit Check Option | 300 – 1,500 | 1 – 6 months | 20% – 35% |

| Credit Union Christmas Loan | 500 – 2,000 | 6 – 12 months | 10% – 15% |

Repayments are usually weekly or fortnightly, allowing borrowers to align payments with their salary or benefit income. Some Christmas loan direct lenders even allow flexible early repayments without extra fees, which helps reduce total interest costs.

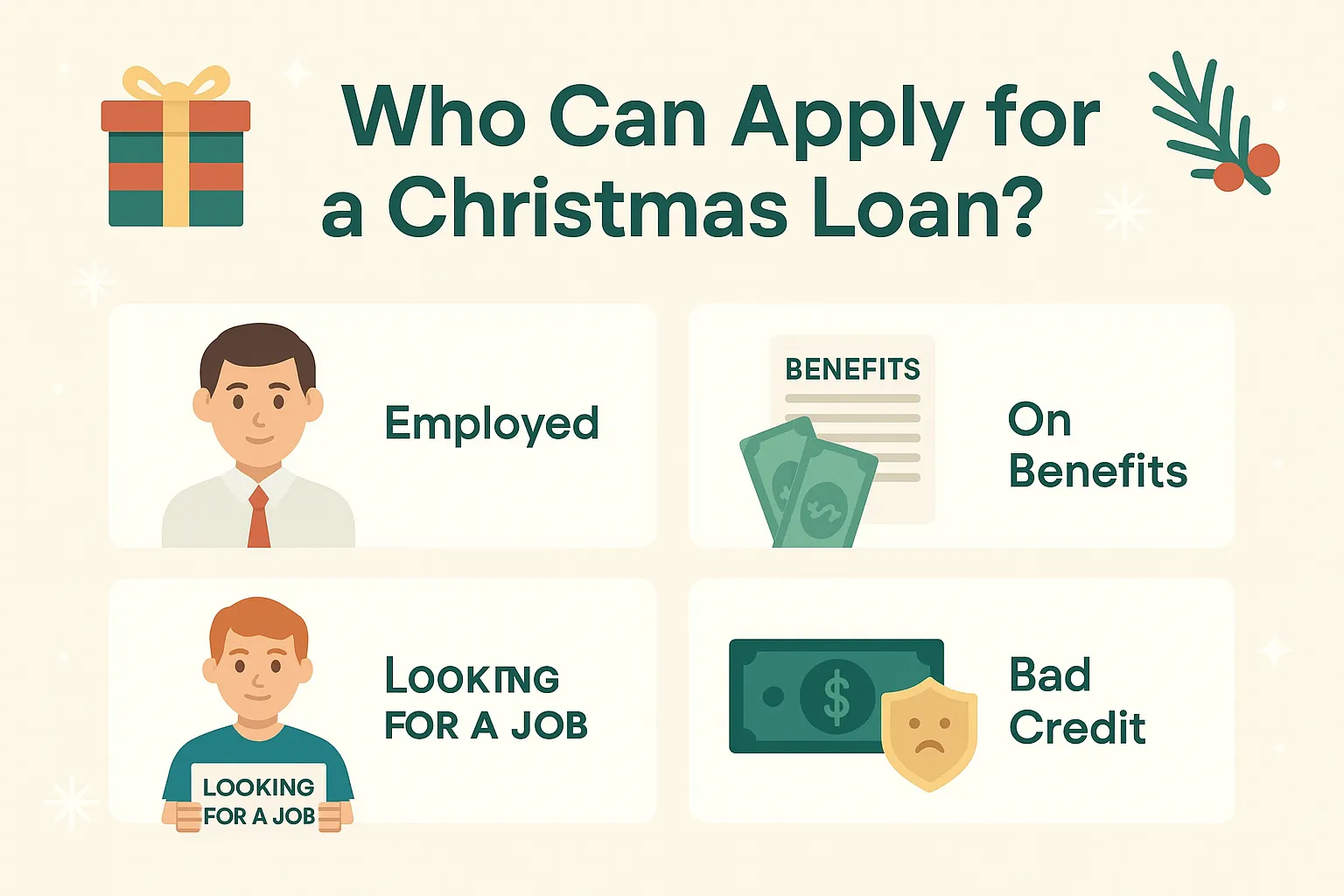

Who Can Apply for a Christmas Loan?

Anyone in New Zealand facing extra living costs over Christmas can apply for a Christmas loan — including those who are employed, self-employed, on benefits, or temporarily out of work. Most lenders provide flexible options so that even people with irregular income can apply for benefit loans for Christmas or Christmas loans for unemployed.

If you’re receiving WINZ or MSD support, some lenders offer Christmas loans NZ tailored for beneficiaries, helping cover holiday expenses without waiting for government payment dates. These short term Christmas loans usually require minimal paperwork — a valid ID, proof of income (including benefit statements), and a bank account.

Those with a low credit score can also explore Christmas loans no credit check, as many direct lenders provide fast approval based on income stability rather than credit history. However, remember that higher-risk applicants may face slightly higher interest rates or smaller borrowing limits.

In short, whether you’re working, receiving benefits, or looking for emergency Christmas loans, there are multiple paths to secure holiday financing — as long as you borrow responsibly and understand repayment terms.

Christmas Loans with No Credit Check

For many borrowers in New Zealand, the biggest holiday challenge is securing funds despite a poor credit score. That’s where Christmas loans no credit check options become useful. These loans allow people with past defaults or limited credit history to still get approved — fast and stress-free.

Some lenders specialize in instant Christmas loans or even guaranteed Christmas loans, meaning they focus on your income stability instead of your credit report. The approval process is quick — often within minutes — and the cash can arrive in your account the same day.

If your credit score is low, you can still apply through Christmas loans bad credit direct lender services. These lenders skip the traditional bank process and assess your affordability directly. You’ll find these options among New Zealand’s top-rated short-term lenders such as:

- Moola – Instant decision with same-day payout.

- Cashburst – Offers emergency Christmas loans for urgent expenses.

- Nector – Fast approval for Christmas cash fast loan applicants.

- Savvy Loans – Known for flexible no credit check options.

- QuickCash NZ – Easy online application with 24/7 support.

⚠️ Note: The lenders listed above are examples only. We recommend reviewing each provider’s terms, rates, and eligibility criteria before submitting your application.

While no credit check Christmas loans sound convenient, borrowers should always check the total repayment cost and ensure they can repay on time. Responsible lending is key — borrowing too much during the holidays can create unnecessary financial stress in the new year.

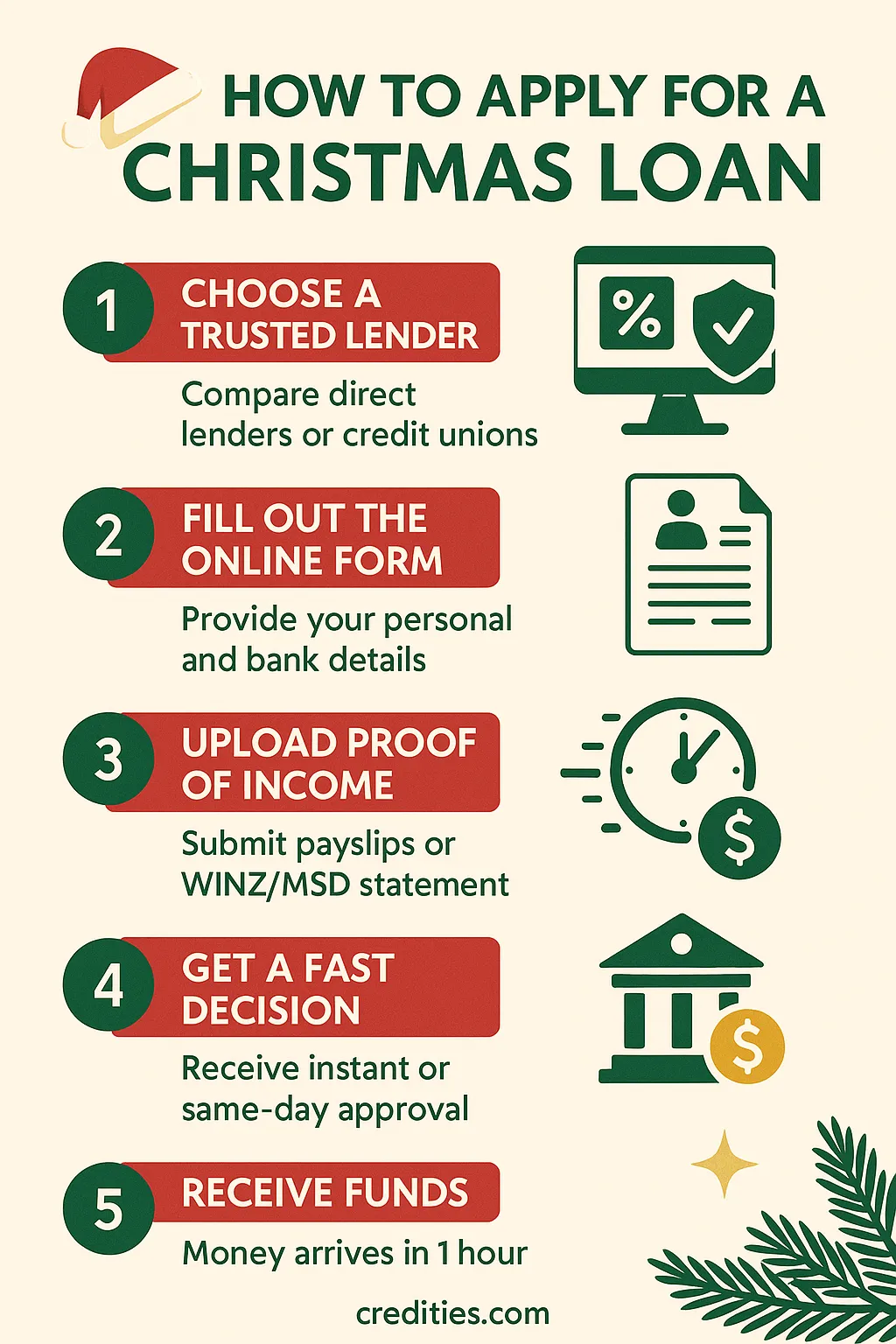

How to Apply for a Christmas Loan (Step-by-Step Guide)

Applying for Christmas loans NZ is quick and straightforward — most applications take less than 10 minutes and can be completed fully online.

Whether you’re using christmas loans direct lenders or credit unions, the process usually follows the same steps 👇

Step 1: Choose a Trusted Lender

Start by comparing direct lenders who specialise in short term Christmas loans or instant Christmas loans. Look for licensed companies like Moola, Cashburst, or QuickCash NZ that have transparent fees and clear terms. If you prefer community options, credit union Christmas loans may offer lower interest rates and seasonal promotions.

Step 2: Fill Out the Online Form

Go to the lender’s official website or search for christmas loans near me to find local branches. The online form usually requires your name, contact info, ID number, and bank account details. If you don’t have a traditional account, some providers offer christmas loans no bank account alternatives via prepaid cards or digital wallets.

Step 3: Upload Proof of Income

Lenders typically request documents showing your earnings — this could be payslips, benefit statements (WINZ/MSD), or self-employment invoices. This helps them determine your affordability and repayment schedule.

Step 4: Get a Fast Decision

Once submitted, most christmas loans direct lenders provide instant or same-day decisions. Some even allow weekend approvals and 24/7 payouts, perfect for last-minute Christmas shopping or emergency expenses.

Step 5: Receive Funds

After approval, the loan amount is transferred directly into your bank account — often within 1 hour. Use it responsibly for gifts, groceries, travel, or to cover any unexpected living costs over Christmas.

Emergency & Instant Christmas Loans

Sometimes the festive season brings unexpected costs — last-minute travel, urgent bills, or gifts you didn’t plan for. In these cases, emergency Christmas loans or instant Christmas loans can help you access cash quickly when you need it most.

These products are designed for speed: once approved, the money is often transferred within minutes or hours, even during weekends. Many direct lenders in New Zealand now offer Christmas cash fast loan services with 24/7 online applications and same-day payouts.

Before applying, it’s smart to check Christmas cash fast loan reviews to ensure the lender is legitimate and trustworthy. Reputable providers such as Moola, Cashburst, and QuickCash NZ clearly show their rates, terms, and repayment dates.

Typical eligibility requirements include:

- Proof of income (employment or benefit statement)

- Valid New Zealand ID

- Active bank account (or alternative payment option)

Because emergency Christmas loans often carry higher interest rates due to the urgency, they should be used carefully — ideally for essential short-term needs, not discretionary shopping. Borrowers should only take out as much as they can afford to repay within the next pay cycle or two.

With responsible use, these fast loans can ease holiday stress and prevent overdraft fees or missed payments — helping you enjoy the season without added financial pressure.

Best Credit Union Christmas Loans in NZ

For borrowers who prefer lower rates and community-based lending, a credit union Christmas loan can be one of the smartest holiday finance options in New Zealand. Unlike fast direct lenders, credit unions are non-profit organisations that return value to their members through lower interest, fewer fees, and personalised service.

Here are some of the most trusted credit unions offering Christmas loans NZ this festive season 👇

1. First Credit Union

Offers seasonal Christmas loan promotion ideas every year, including reduced interest rates and flexible repayment terms. Typical amounts range from NZD $500 – $3,000, with repayment periods of up to 12 months. Members can apply online and receive decisions within one business day.

2. NZCU Baywide

Known for responsible lending, NZCU Baywide provides credit union Christmas loans with interest rates as low as 9.9% p.a. Their “Holiday Helper” campaign lets members borrow small amounts to manage extra expenses like gifts and travel.

3. Unity Credit Union

Unity focuses on community-driven finance. Their short term Christmas loans can be used for family celebrations or covering unexpected living costs over Christmas. They also promote budgeting tools to help members avoid overspending during the holidays.

4. Police Credit Union & Firefighters Credit Union

These unions occasionally offer Christmas loan promotion ideas, such as deferred first payments or bonus reward draws for early applicants.

In summary, credit union Christmas loans are ideal for those wanting transparent terms, fair interest, and member benefits — all while supporting local financial cooperatives.

⚠️ Note: The lenders listed above are examples only. We recommend reviewing each provider’s terms, rates, and eligibility criteria before submitting your application.

Pros & Cons of Christmas Loans

| Pros (Advantages) | Cons (Disadvantages) |

|---|---|

| 🎁 Fast access to cash, flexible short term Christmas loans, and options like no credit check or benefit loans for Christmas make it easy to cover holiday expenses on time. | 💸 Higher interest rates, risk of overspending, and short repayment periods can lead to extra financial stress if not managed responsibly. |

Conclusion

The holiday season can be expensive, but Christmas loans NZ offer a practical way to manage extra costs for gifts, food, and family celebrations. Whether you choose a credit union Christmas loan, a short term Christmas loan, or even instant Christmas loans from direct lenders, always borrow responsibly and review the repayment terms before applying.

If you’re on a benefit or need cash urgently, options like benefit loans for Christmas and emergency Christmas loans can help bridge the gap — just ensure the loan fits your budget and repayment ability.

For more year-round options, check our related guides on Immediate Loans in New Zealand] and Loans for Beneficiaries NZ.