Doorstep loans are small, short-term cash loans delivered directly to your home by a lending agent, with weekly repayments collected in person.

They are designed for people who may struggle to access mainstream credit options. A loan agent visits your home to discuss the amount, terms, and repayment schedule. Once approved, the funds are handed over in cash, and repayments are usually made weekly at your doorstep.

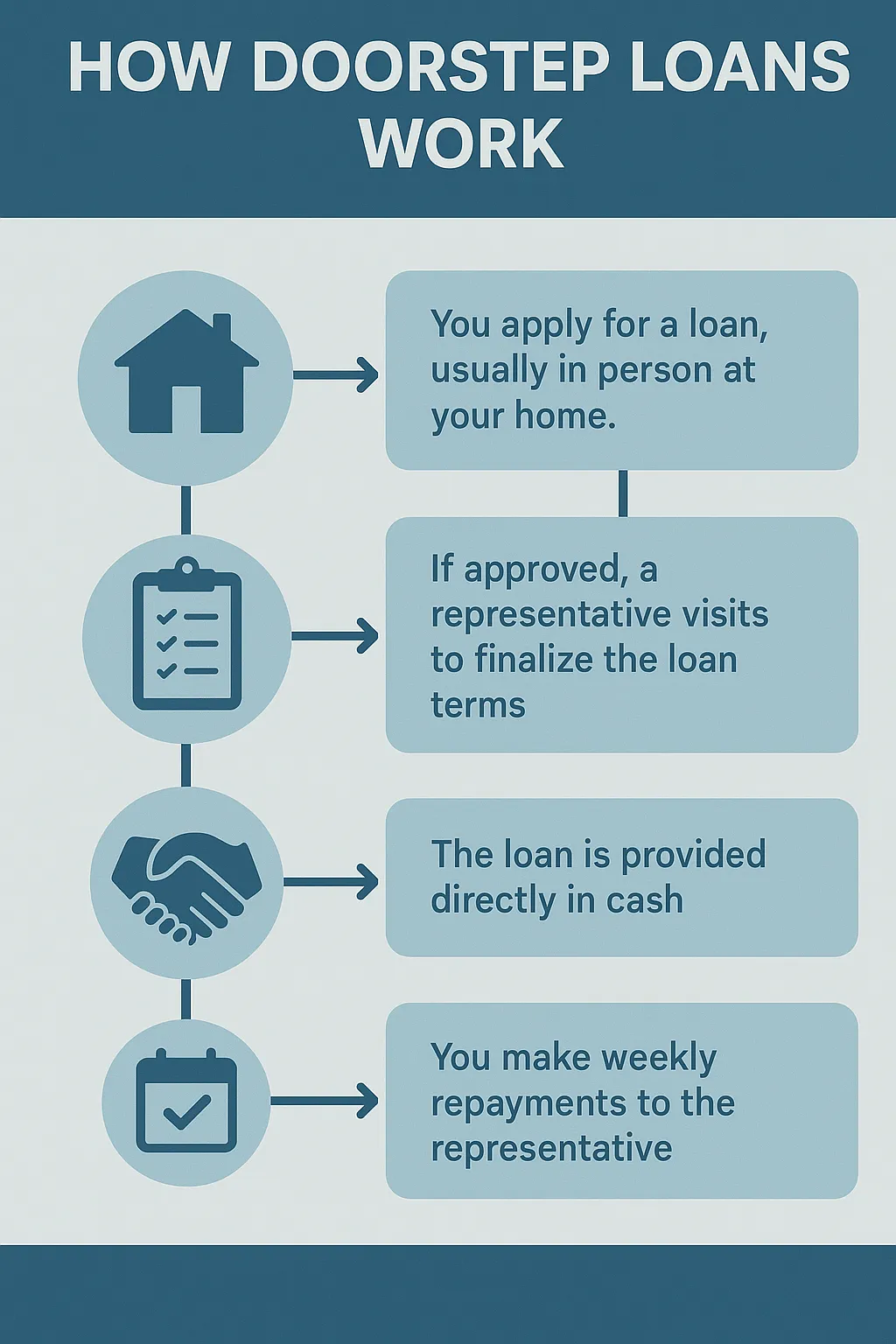

How Do Doorstep Loans Work?

Doorstep loans follow a simple home-collection model:

Step 1: Apply online or via phone with a doorstep lender.

Step 2: A loan agent visits your home to verify documents and explain terms.

Step 3: If approved, cash is handed over on the spot.

Step 4: Weekly repayments are collected in person by the same agent.

This process makes doorstep loans accessible for people with poor credit or limited internet access, though they often carry higher interest rates than bank loans.

Are Doorstep Loans Easier to Get?

Doorstep loans are generally easier to obtain than personal loans from traditional banks because:

Lenders focus on affordability rather than strict credit checks.

No guarantor is usually required.

Approval can be same-day for small amounts.

However, this ease of access comes at a cost — interest rates and fees can be significantly higher than standard lending options.

Are Doorstep Loans Legal?

In the UK, doorstep loans are legal as long as the lender is authorised by the Financial Conduct Authority (FCA). Legitimate doorstep lenders must:

Be listed on the FCA Register

Provide clear documentation on loan terms

Follow responsible lending practices

In the USA, doorstep loans are less common and often fall under state-specific payday or personal loan regulations. Always check whether the lender is state-licensed before borrowing.

Tip: Avoid unlicensed lenders offering cash loans without paperwork or FCA registration — these are often illegal loan sharks.

Doorstep Loans & Credit Impact

Many borrowers ask:

Does a doorstep loan go on my credit file?

Will it affect my credit score?

The answer:

Yes, most doorstep loans appear on your credit report if provided by regulated lenders.

Making on-time payments can improve your credit score over time.

Missed or late payments can negatively affect your credit history, just like any other loan.

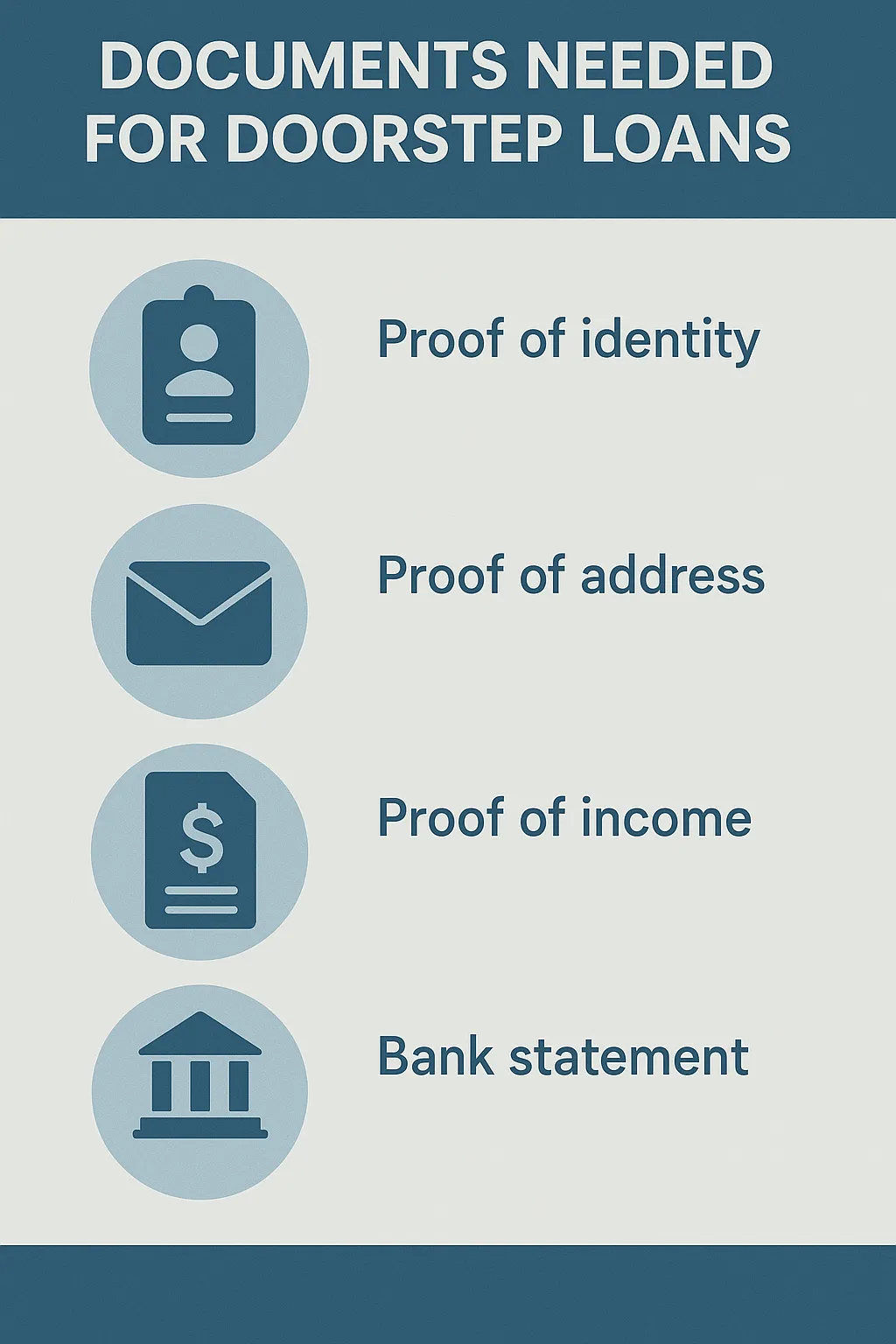

Eligibility & Documents Needed for a Doorstep Loan

To apply for a doorstep loan, you typically need:

| Document Type | Purpose | Examples |

|---|---|---|

| ID Proof | Identity verification | Passport, Driving Licence |

| Proof of Address | Residency confirmation | Utility Bill, Council Tax Bill |

| Income Evidence | Affordability assessment | Payslips, Bank Statements |

Additional requirements may include:

Being 18+ years old

UK residency status

A stable source of income

How to Get a Doorstep Loan (Step-by-Step Guide)

Applying for a doorstep loan is usually quick and straightforward:

Step 1: Compare Lenders

Look for FCA-authorised doorstep loan providers in the UK.

Check interest rates, repayment terms, and customer reviews.

Step 2: Submit Your Application

Apply online, by phone, or directly with a local agent.

Step 3: Home Visit & Approval

A representative visits your home to verify documents and discuss loan details.

Approval can be same-day for small amounts.

Step 4: Receive Cash at Your Doorstep

Funds are handed over immediately after approval.

Step 5: Weekly Repayments

A loan agent collects payments at your home on agreed dates.

Repayment & Legal Questions

Common borrower concerns include:

Can I pay a doorstep loan early? – Yes, many lenders allow early repayment; ask about potential fees.

Can you get away with not paying a doorstep loan? – No. Non-payment can lead to collection actions and credit score damage.

Tip: If facing difficulties, contact your lender to arrange payment plans before missing instalments.

Borrowing Limits for First-Time Applicants

First-time doorstep loan customers often face lower borrowing limits until a repayment history is established:

Typical amounts: £100 – £500 initially

- 200 Pound Loan; Easy Cash Options in the UK

Limits may increase with on-time repayments for future loans

Some lenders offer larger loans only after multiple successful repayments and income verification.

Why Some Doorstep Lenders Avoid Buzzer Entry Flats

Some doorstep lenders may refuse to serve properties with buzzer-only access because:

Security concerns: Loan agents carry cash, so restricted access may pose safety risks.

Insurance policies: Some lenders’ insurance won’t cover agents in locked communal buildings.

Accessibility issues: Missed collections due to restricted entry can disrupt repayment schedules.

Borrowers living in flats with buzzer entry should confirm service availability before applying.

Pros & Cons of Doorstep Loans

| Pros | Cons |

|---|---|

| Quick access to cash | Higher interest rates than bank loans |

| Simple application process | Limited borrowing amounts for first-time users |

| No guarantor required in most cases | Weekly home visits may feel intrusive |

| Helps those with poor credit history | Missed payments affect credit score negatively |

Alternatives to Doorstep Loans

If doorstep loans are unsuitable, consider these options:

Credit Unions: Lower interest rates, community-focused lending.

Online Installment Loans: More privacy and flexible repayment schedules.

Payday Loan Alternatives: Short-term emergency funding for urgent needs.

Government Hardship Funds: Emergency grants or low-cost loans for low-income households.

- Alternative Ways to Access Credit if You Have a Low Credit Rating

FAQs

Q1: Are doorstep loans easier to get than bank loans? → Yes, because lenders focus on affordability and income rather than strict credit scores.

Q2: Do doorstep loans affect your credit score? → Yes, on-time repayments can improve your score, while missed payments can lower it.

Q3: Can I pay off a doorstep loan early? → Yes, many lenders allow early repayment, but always check for potential fees.

Q4: Are doorstep loans legal in the UK? → Yes, if offered by FCA-authorised lenders following responsible lending practices.

Q5: What documents are needed for a doorstep loan? → You’ll usually need proof of identity, proof of address, and income evidence.