Government hardship loans in the UK provide essential financial support to individuals and families facing unexpected expenses, emergencies, or temporary income loss.

These loans aim to prevent people from falling into severe debt during crises such as job loss, health emergencies, or rising living costs. In this guide, we cover all types of government hardship loans, eligibility criteria, application steps, and alternatives for people who need urgent financial help in 2025.

| 200 Pound Loan |

| No Credit Check Loans |

| Debt Repayment Plan |

Government hardship loans are short-term, low-interest or interest-free financial assistance programmes offered by the UK government or local councils.

What Are Government Hardship Loans?

They are designed to help people cover essential expenses like rent, utilities, or emergency bills when regular income is insufficient.

Key purposes include:

Emergency housing or utility payments

Medical and family-related expenses

Short-term support during unemployment or illness

These loans are usually repayable over flexible terms and are separate from commercial payday or personal loans.

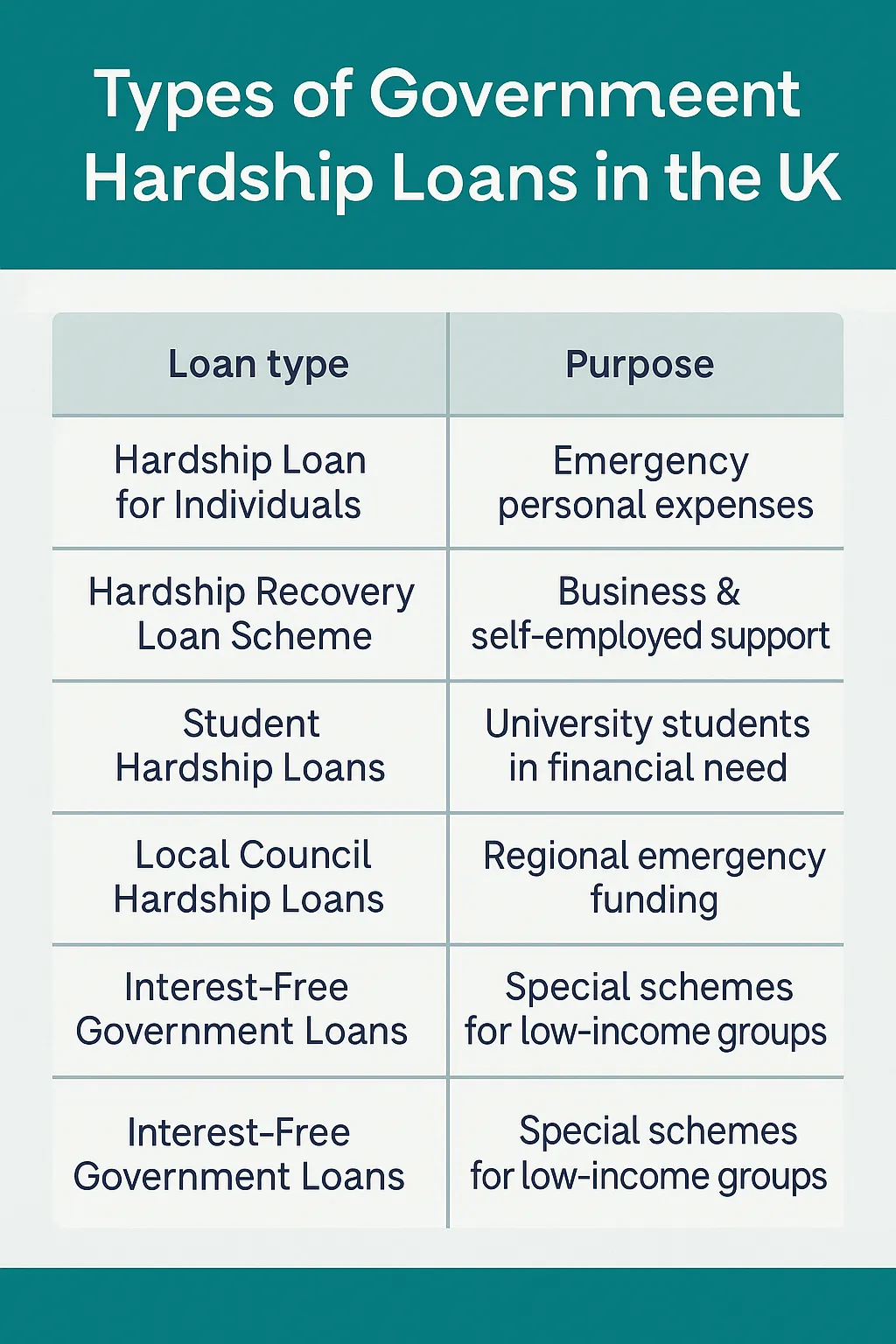

Types of Government Hardship Loans in the UK

| Loan Type | Purpose | Max Amount | Repayment Terms |

|---|---|---|---|

| Hardship Loan for Individuals | Emergency personal expenses | £100–£1,000 | 6–24 months |

| Hardship Recovery Loan Scheme | Business & self-employed support | £1,000–£10,000 | 1–5 years |

| Student Hardship Loans | University students in financial need | £100–£3,000 | Term-based repayment |

| Local Council Hardship Loans | Regional emergency funding | Varies by council | Varies by programme |

| Interest-Free Government Loans | Special schemes for low-income groups | £100–£2,000 | 6–36 months |

Each loan type has different eligibility criteria and application processes, which we will explain in detail later in this guide.

Government Financial Hardship Loans Explained

Government financial hardship loans are designed for individuals and families facing temporary financial crises. Unlike commercial loans, they often have:

Lower or zero interest rates

Flexible repayment terms

Specific eligibility requirements tied to income or benefits

These loans help prevent people from turning to high-cost payday lenders and can cover:

Emergency utility bills

Rent arrears

Medical expenses

Short-term living costs during unemployment or illness

In some cases, these loans are administered by local councils or through national schemes such as the Budgeting Loan or Hardship Recovery Loan Scheme.

Free Government Hardship Loans – Myth or Reality?

Many people search for “free government hardship loans”, but it’s important to understand the reality:

Most hardship loans must be repaid, even if interest-free

Truly free financial help usually comes in the form of grants or charity assistance rather than loans

Some councils offer non-repayable crisis funds for essential needs like food or emergency accommodation

Key takeaway: If you see “free loans” advertised, always verify the source. Legitimate government schemes in the UK are clearly listed on GOV.UK or local council websites and will never charge upfront fees.

Hardship Loans from Local Government

Local councils across the UK often run hardship support schemes to help residents in financial distress. These loans or grants may cover:

Food vouchers or energy bills

One-off essential household costs

How to apply:

Visit your local council’s website

Search for “Local Welfare Assistance” or “Hardship Support Scheme”

Submit required documents such as ID, proof of income, and evidence of hardship

Each council sets its own eligibility criteria and funding limits, so approval times and amounts can vary significantly.

Government Hardship Loan Scotland

In Scotland, hardship assistance is often managed under the Scottish Welfare Fund.

Two main types of support exist:

Crisis Grants – Non-repayable funds for immediate needs such as food, heating, or essential travel

Community Care Grants – For people leaving care, hospital, or facing exceptional financial pressure

While some loans exist, Scotland primarily provides grants rather than repayable hardship loans, making support more accessible for low-income households.

Government Hardship Recovery Loan Scheme

The Hardship Recovery Loan Scheme was introduced to help individuals and businesses recover from pandemic-related financial impacts.

Key features include:

Loan amounts from £1,000 up to £10,000 for individuals or SMEs

Repayment terms of 1–5 years with capped interest rates

Eligibility for those impacted by COVID-19 or similar economic crises

This scheme aims to support self-employed workers, small businesses, and individuals with temporary income loss to stabilise their finances and rebuild creditworthiness.

Tip: Alternative Ways to Access Credit if You Have a Low Credit Rating

Government Student Hardship Loans

UK universities and student finance bodies offer student hardship loans for those struggling with essential costs such as accommodation, books, or food.

Key details:

Usually interest-free or very low interest

Available through Student Finance England or university hardship funds

May require proof of enrolment, income, and expenses

Students can apply via their university’s student support office or official government portals for emergency assistance.

Eligibility Criteria for Government Hardship Loans

While requirements vary by programme, most hardship loans have common eligibility factors:

Residency: Must be a UK resident or legally entitled to public funds

Income limits: Proof of low income or sudden loss of income required

Purpose of loan: Funds must be used for essentials such as housing, utilities, or emergency costs

Documentation: ID, proof of address, recent bank statements, and evidence of hardship

Some schemes, such as local council or student loans, may have additional regional or institutional requirements.

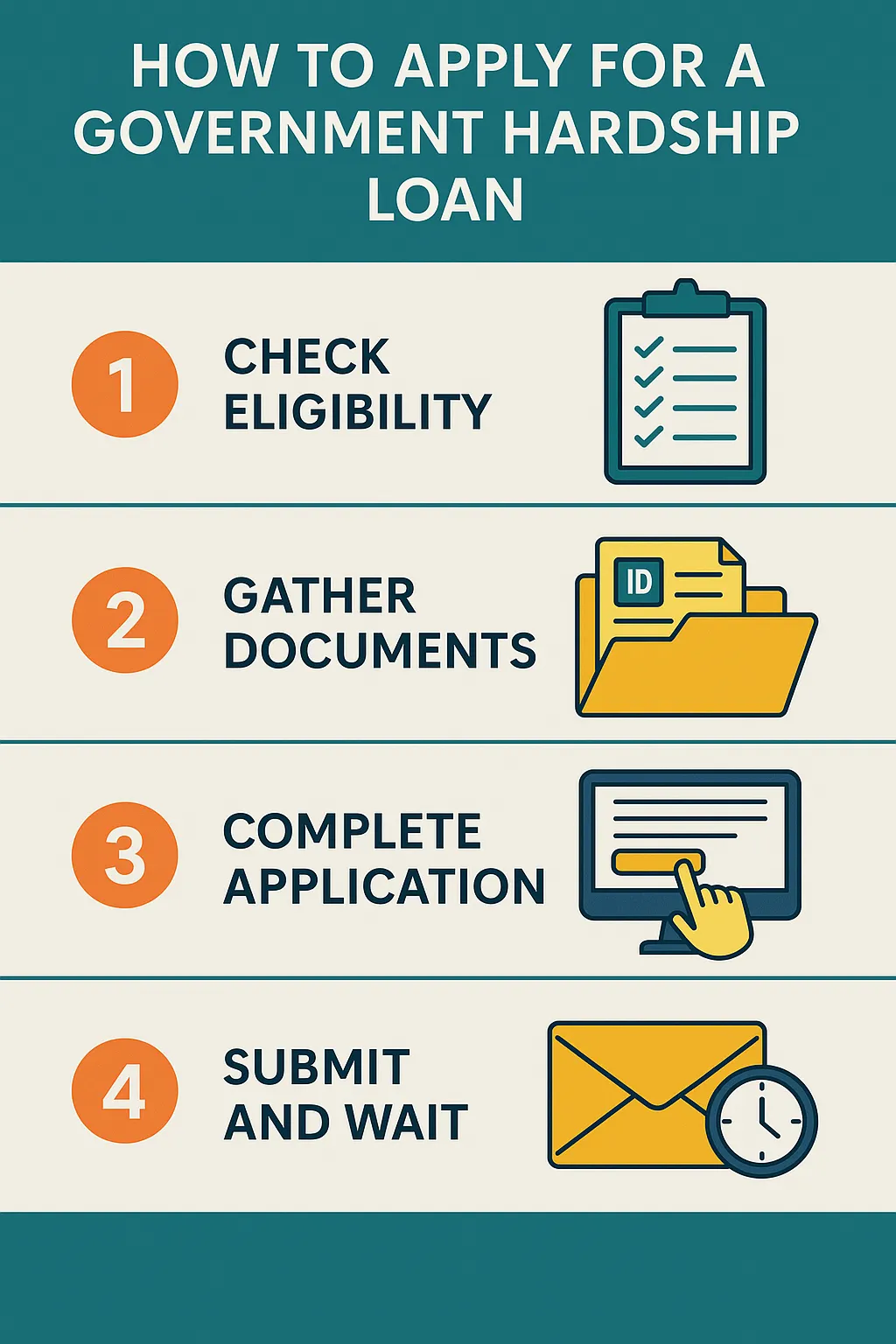

How to Apply for Government Hardship Loans

The application process generally involves:

Identify the scheme: Check GOV.UK, local council websites, or your university’s support page

Gather documents: ID, income proof, and a short explanation of financial hardship

Submit application online or in person: Many councils and universities offer online portals for faster processing

Await assessment: Decision times vary from 24 hours to a few weeks depending on the scheme

Tip: Always apply early as funding is often limited and given on a first-come, first-served basis.

Pros & Cons of Government Hardship Loans

| Pros | Cons |

|---|---|

| Low or zero interest rates | Funding availability varies by region and programme |

| Supports essential needs during financial crisis | Application processes can take time |

| Often flexible repayment terms | Not always suitable for long-term financial needs |

| Widely accessible through councils & universities | Strict eligibility criteria may apply |

Alternatives to Government Hardship Loans

If you do not qualify for a government hardship loan or need additional support, consider:

Credit Union Loans: Low-cost, community-based lending

Charity Assistance: Many charities offer grants or vouchers for essentials

Salary Advance Schemes: Some employers provide interest-free wage advances

- Budgeting & Crisis Grants: Non-repayable funds from local councils for urgent needs

- Food Banks & Community Support: Emergency aid for essentials like food and clothing

FAQs

Are government hardship loans interest-free? → Some are interest-free, especially student loans and certain local council schemes.

How quickly can I get a hardship loan in the UK? → Emergency schemes may approve funding within 24–48 hours, while others take longer.

Can international students apply for hardship loans? → Usually only UK residents or those with access to public funds qualify, but some universities offer emergency support for international students.

What documents are required? → Typically ID, proof of income, proof of residency, and evidence of financial hardship.

Are hardship grants better than hardship loans? → Grants do not require repayment, so they are preferable if available.