You can get no credit check loans in Birmingham, AL from payday lenders, installment loan providers, and direct lenders specialising in bad credit options.

Where Can I Get Loan With No Credit Check in Birmingham?

For borrowers struggling with a poor credit history, traditional banks often reject applications. However, in Birmingham, AL, many lenders offer fast, flexible loans without strict credit checks. This guide explains the types of loans available, eligibility criteria, application steps, and the pros and cons of borrowing without a credit check.

| £5000 Loans for Bad Credit |

| Government Hardship Loans UK |

| Provident Loans UK |

What Are No Credit Check Loans in Birmingham?

No credit check loans are short-term or installment-based loans where lenders do not run a hard credit inquiry. Instead, they focus on:

Proof of income

Employment stability

Ability to repay

These loans are ideal for:

People with bad or very bad credit

Borrowers needing same-day approval

Those seeking smaller loan amounts without the hassle of lengthy paperwork

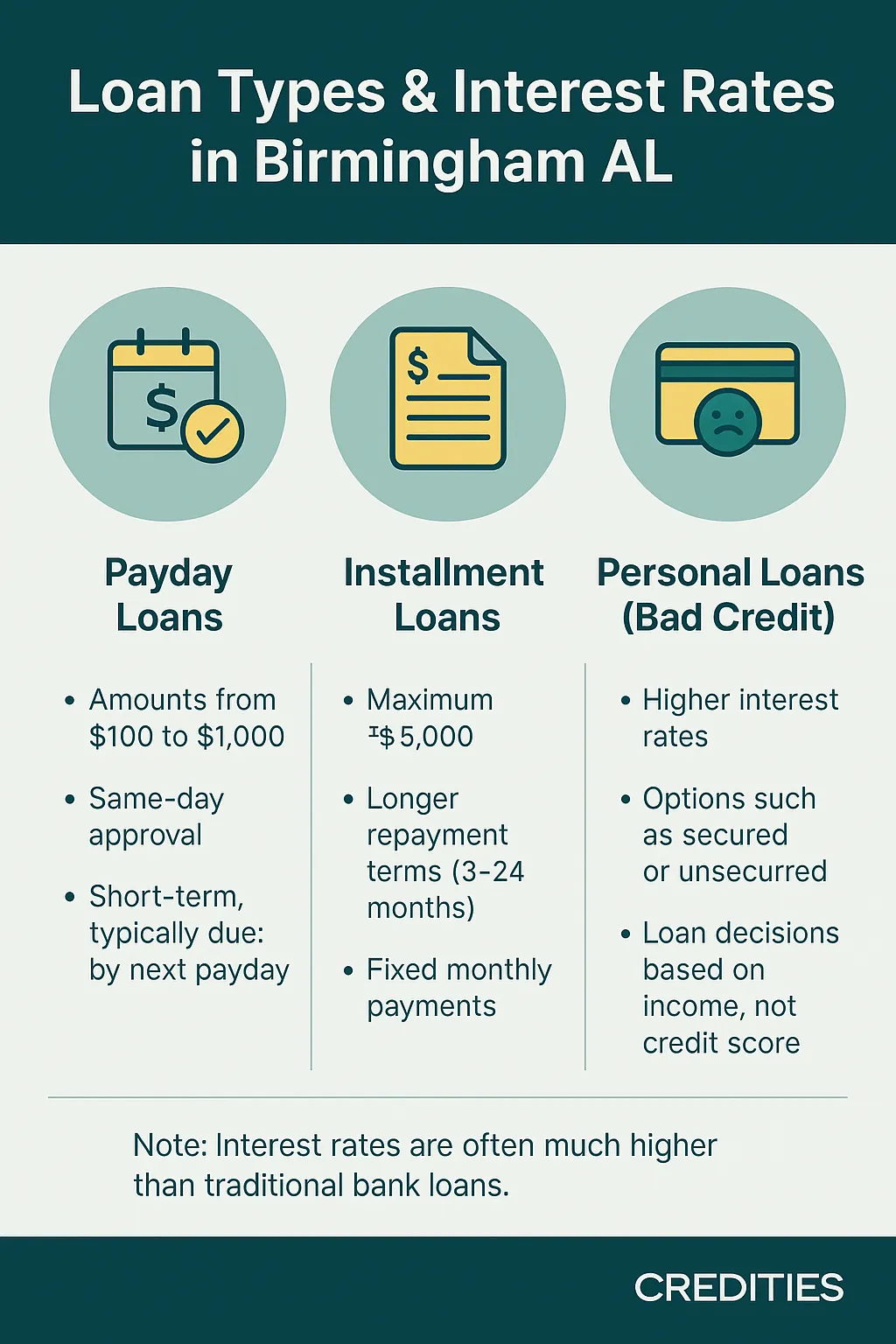

Types of No Credit Check Loans in Birmingham

| Loan Type | Max Amount | Approval Time | Typical Term |

|---|---|---|---|

| Payday Loans Birmingham AL | $100 – $1,000 | Same day | 2–4 weeks |

| Installment Loans Birmingham AL | $500 – $5,000 | 24–48 hours | 3–24 months |

| Bad Credit Personal Loans Birmingham | $1,000 – $10,000 | 1–3 days | 6–60 months |

Payday Loans With No Credit Check in Birmingham

Payday loans are small, short-term loans that provide fast cash for urgent expenses like utility bills or car repairs. In Birmingham, AL, some lenders offer payday loans with no hard credit checks, focusing instead on your income and employment status.

Key features:

Loan amounts from $100 to $1,000

Same-day approval for most applicants

Repayment due on your next payday

Important: Payday loans come with high interest rates, so they should only be used for emergencies, not long-term borrowing.

Installment Loans No Credit Check Birmingham AL

Unlike payday loans, installment loans allow you to borrow larger amounts — up to $5,000 — and repay in fixed monthly installments over several months or even years.

Advantages:

Lower monthly payments compared to payday loans

Longer repayment terms (3–24 months)

Better for borrowers needing flexible repayment options

Some installment lenders in Birmingham offer no credit check options or perform only soft checks that don’t impact your credit score.

Bad Credit Loans in Birmingham AL

If you have very bad credit, you can still find lenders offering personal loans in Birmingham. These loans often have:

Higher interest rates due to increased risk

Options for both secured (using collateral) and unsecured loans

Direct lenders specialising in bad credit personal loans

Some lenders also offer same-day funding if you provide proof of income and identification quickly.

Eligibility Criteria for No Credit Check Loans in Birmingham

Most lenders offering no credit check loans in Birmingham have basic eligibility requirements:

Age: Minimum 18 years old

Residency: Must be a U.S. citizen or permanent resident living in Birmingham, AL

Income: Proof of stable monthly income (employment or benefits)

Bank Account: Active checking account for direct deposit

ID Verification: Valid government-issued photo ID

Some lenders may also request proof of address or recent bank statements before approving your application.

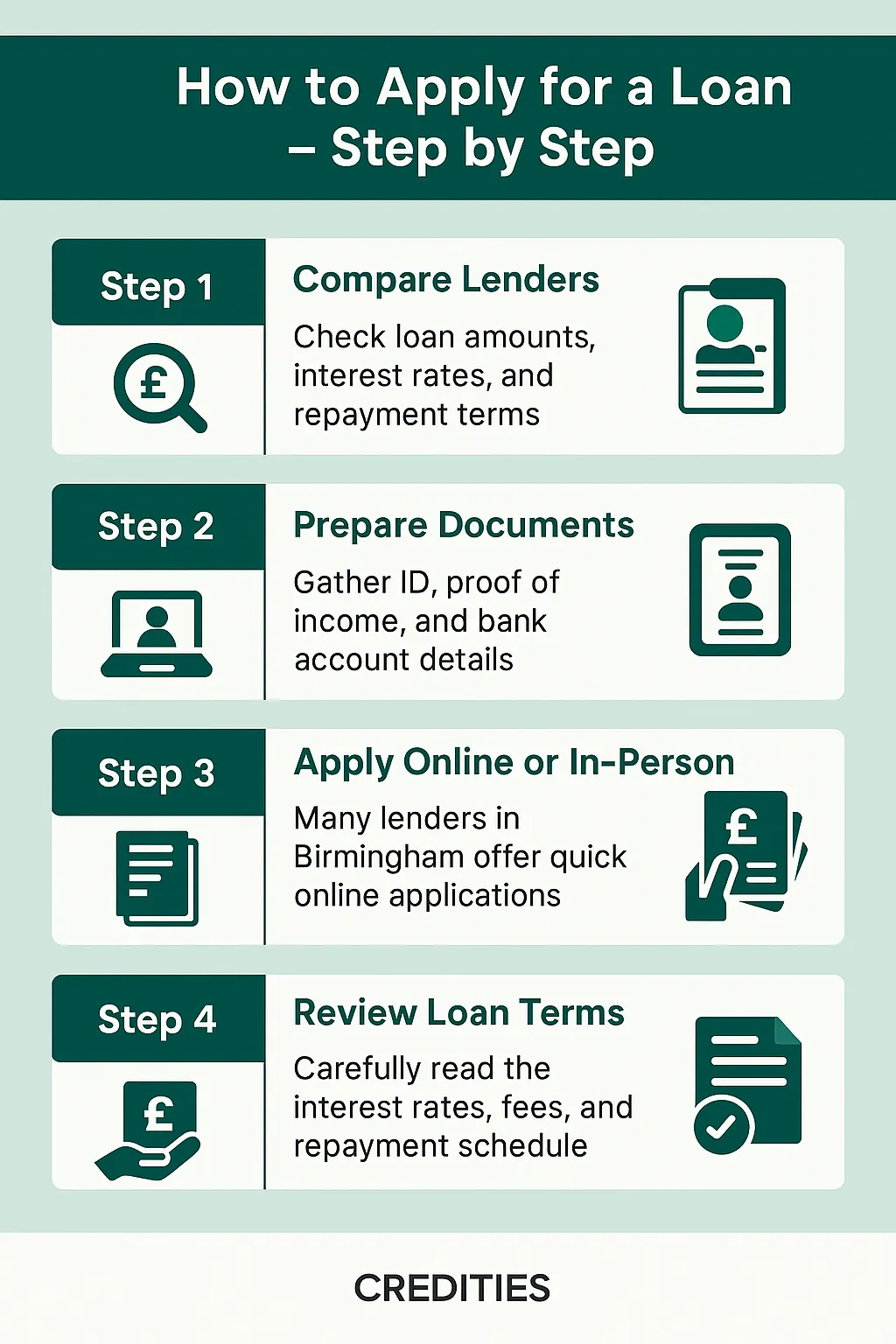

How to Apply for No Credit Check Loans in Birmingham (Step-by-Step)

Step 1: Compare Lenders

Check loan amounts, interest rates, and repayment terms

Step 2: Prepare Documents

Gather ID, proof of income, and bank account details

Step 3: Apply Online or In-Person

Many lenders in Birmingham offer quick online applications

Step 4: Review Loan Terms

Carefully read the interest rates, fees, and repayment schedule

Step 5: Receive Funds

Some lenders provide same-day or next-day funding after approval

Pros & Cons of No Credit Check Loans Birmingham

| Pros | Cons |

|---|---|

| Accessible for bad credit borrowers | Higher interest rates than traditional bank loans |

| Fast approval, often same-day funding | Risk of debt cycle if not repaid on time |

| Simple application process | Shorter repayment terms for payday loans |

| Available online and in-person in Birmingham | Limited regulation for some lenders → risk of scams |

Alternatives to No Credit Check Loans in Birmingham

If you do not qualify for a no credit check loan or want to explore cheaper options, consider:

Credit Unions in Birmingham: Offer low-interest small loans for members

Employer Salary Advance Programs: Some employers provide early wage access

Government Hardship Assistance: Temporary support for emergencies

Borrowing from Family/Friends: Interest-free if repaid responsibly

Community Assistance Funds: Local charities or churches may offer help for essentials

Where Can I Get Loan With No Credit Check in Sheffield?

FAQs

Q1: Can I get same-day loans in Birmingham AL with no credit check? Yes, many payday and installment lenders offer same-day funding if you apply early with all required documents.

Q2: What are the interest rates for payday loans in Birmingham? Rates vary but are typically higher than bank loans. Always compare multiple lenders before applying.

Q3: Do I need a guarantor for bad credit personal loans? Most lenders do not require a guarantor for small loans, but larger loans may need one.

Q4: Are no credit check loans safe? They are safe if you choose FCA-regulated or state-licensed lenders and read the terms carefully.

Q5: Can installment loans help rebuild my credit? Yes, on-time payments for installment loans can improve your credit history over time.