Payday loans in Newcastle are available from local shops and online lenders, with fast approval and options across the UK, USA, and Australia.

Payday loans in Newcastle are short-term cash advances designed to help cover urgent expenses until your next payday. Whether you live in Newcastle upon Tyne (UK), Newcastle-under-Lyme, or even overseas in Newcastle NSW (Australia) or Newcastle Delaware (US), there are both online and local lenders offering quick access to funds.

Most payday loans provide same-day approval, minimal paperwork, and flexible repayment options such as weekly or monthly instalments. This guide covers everything you need to know about payday loans in Newcastle, from local loan shops and online applications to eligibility requirements, repayment terms, and pros & cons of using these high-cost credit products.

Payday Loans Newcastle Upon Tyne (UK)

Payday loans in Newcastle upon Tyne are short-term cash advances available from both local loan shops and online payday lenders. They are popular for borrowers with urgent financial needs, as approval is often granted within hours.

Loan amounts: Usually between £100 and £1,000

Repayment: Due on your next payday or extended over a few weeks/months

Eligibility: UK residents aged 18+, with proof of income and ID

Many lenders in Newcastle offer same-day cash collection or direct bank transfer, giving borrowers flexibility based on preference.

Payday Loan Shops Newcastle Upon Tyne

Some borrowers prefer in-store payday loan shops in Newcastle for face-to-face service. These shops often provide:

Immediate cash once approved

A clear repayment schedule explained in person

The option to repay weekly instead of monthly

However, online payday loans are usually faster and more convenient, especially outside business hours. Many online lenders in Newcastle also provide 24/7 applications with instant approval decisions.

Payday Loans in Newcastle-Under-Lyme (UK)

Borrowers in Newcastle-under-Lyme (Staffordshire) can also access payday loans from direct lenders and credit brokers. Loan terms are similar to those in Newcastle upon Tyne:

£200 – £1,000 loans for short-term emergencies

Flexible repayment plans (weekly or monthly)

Minimal paperwork required

Some lenders in this region operate both in-store branches and online platforms, offering more choice depending on whether you prefer cash in hand or bank transfer.

Payday Loans Newcastle NSW (Australia)

In Newcastle, New South Wales, payday loans are offered by licensed lenders who must follow Australian credit regulations. Borrowers can typically access:

$200 – $2,000 AUD short-term payday loans

Repayment terms: 16 days to 12 months

Eligibility: Must be 18+, with proof of income and ID

⚠️ Note: In Australia, payday lenders are regulated by ASIC. Borrowers should always check that the lender is properly licensed before applying.

Payday Loans Newcastle Delaware (US)

Payday loans in Newcastle, Delaware are regulated under state lending laws. Borrowers can apply for:

$100 – $1,000 USD payday loans

Repayment: Typically due on next payday (14–30 days)

Requirements: Proof of employment, income, and valid ID

⚠️ Delaware law limits the number of payday loans you can have at one time. Always confirm lender licensing to avoid predatory practices.

Payday Loans Newcastle OK (US)

In Newcastle, Oklahoma, payday loans are widely available from both storefronts and online providers.

Loan amounts: $50 – $500 USD

Repayment: Must be completed by next payday

Interest caps: Regulated by Oklahoma state law

Local lenders may also offer pay weekly instalment options, giving borrowers more flexibility.

Payday Loans Newcastle ME (US)

Newcastle, Maine is a small town where in-person payday loan shops are rare. Most borrowers rely on:

Online payday loans with quick approval

Direct deposit of funds within 24 hours

Alternatives such as credit unions or short-term instalment loans

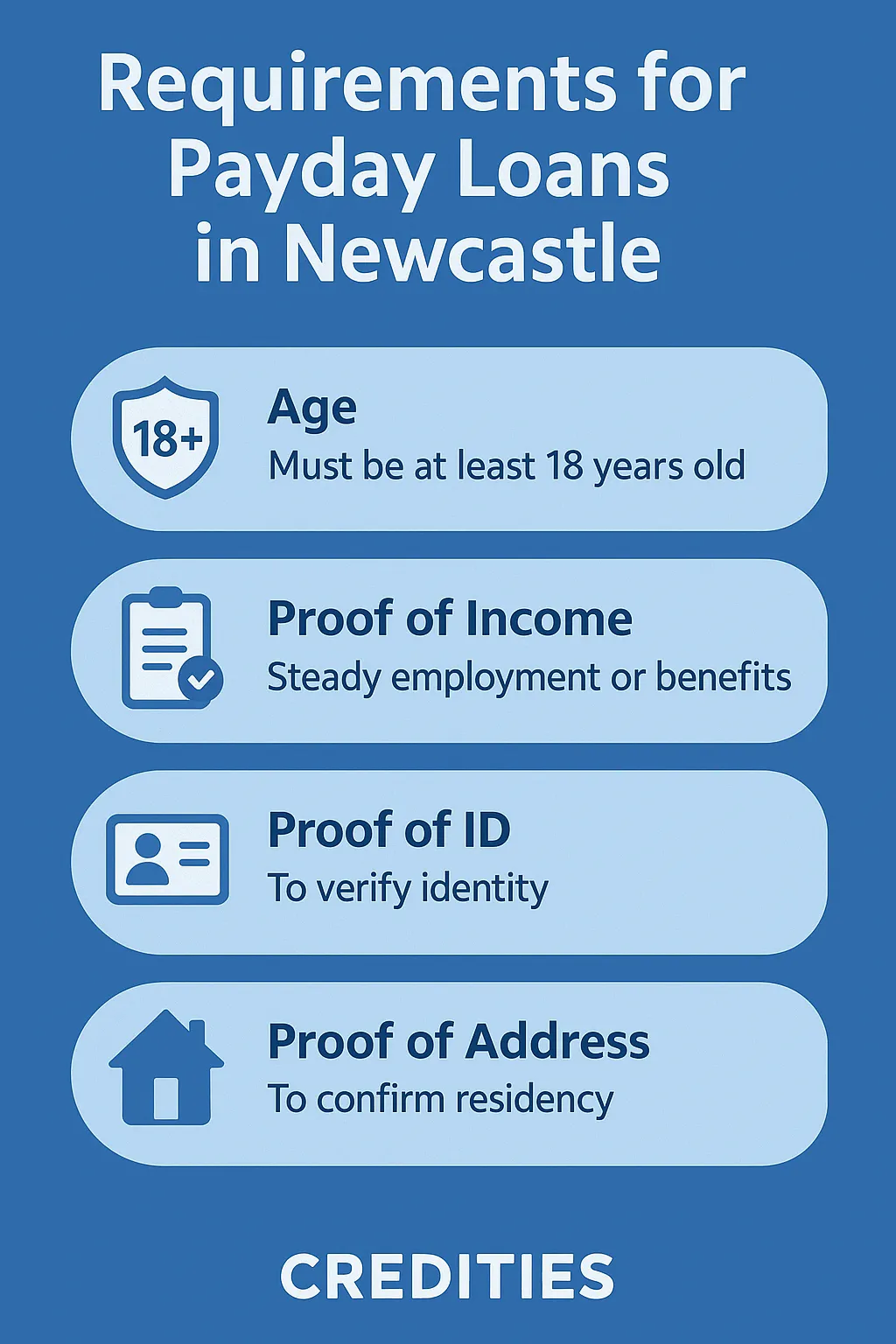

Eligibility & Requirements for Payday Loans in Newcastle

To apply for a payday loan in any Newcastle location, you’ll typically need:

| Requirement | Details | Examples |

|---|---|---|

| Age | Must be at least 18 years old | UK, US, and AUS regulations |

| Proof of Income | Steady employment or benefits | Payslips, bank statements |

| Proof of ID | To verify identity | Passport, driving licence |

| Proof of Address | To confirm residency | Utility bill, council tax bill |

👉 Some lenders also ask for a bank account for repayments, even if cash is collected in-store.

How to Apply for a Payday Loan – Step by Step

Step 1: Compare Lenders

Check both local shops and online payday lenders in Newcastle.

Step 2: Submit Application

Provide personal details, ID, and proof of income online or in-store.

Step 3: Approval Decision

Many lenders give instant approval, while some take a few hours.

Step 4: Receive Funds

Choose between cash in hand (shop) or bank transfer (online).

Step 5: Repay on Payday

The loan is repaid on your next payday, or over weekly instalments if available.

Pros & Cons of Payday Loans Newcastle

| Pros | Cons |

|---|---|

| Fast approval, sometimes within hours | High interest rates compared to personal loans |

| Available for borrowers with bad credit | Short repayment terms can create pressure |

| Choice of online or in-store loans | Not suitable for large borrowing needs |

| Weekly repayment options available | Missed payments may affect your credit score |

Alternatives to Payday Loans in Newcastle

If payday loans don’t suit your needs, there are safer and often cheaper alternatives:

Credit Unions – Community-based lenders with fair interest rates and flexible repayment options.

Instalment Loans – Spread repayments over a few months instead of a single payday.

Overdraft Facilities – Some banks offer arranged overdrafts that may cost less than payday loans.

Government Hardship Funds – In the UK, local councils may provide emergency support for essential expenses.

Borrowing from Family or Friends – Interest-free support can reduce financial stress compared to payday lending.

- Alternative Ways to Access Credit if You Have a Low Credit Rating

FAQs

Q1: Can I get a payday loan in Newcastle with bad credit? → Yes, many lenders in Newcastle approve payday loans for borrowers with bad credit, focusing more on income than credit history.

Q2: Are payday loans legal in Newcastle NSW (Australia)? → Yes, payday loans are legal in Australia but regulated by ASIC, which enforces strict lending rules.

Q3: How fast can I get payday loans in Newcastle upon Tyne? → Some lenders offer same-day cash in-store, while online payday lenders may transfer funds within a few hours.

Q4: Do payday loans affect my credit score? → Yes, missed payments are reported to credit agencies and can negatively impact your credit score.

Q5: Can I repay a payday loan weekly in Newcastle? → Yes, some lenders allow weekly repayments, making it easier to manage smaller instalments.