Provident Loans has long been one of the most recognizable names in the UK short-term lending industry. Whether you are looking for a Provident loan for emergency expenses, a small personal loan, or simply want to learn about Provident loans login and repayment options, this in-depth guide covers everything you need to know in 2025.

We will walk through the types of loans available, eligibility criteria, application steps, repayment plans, customer reviews, and even how to reach Provident loans contact number for help.

What Are Provident Loans?

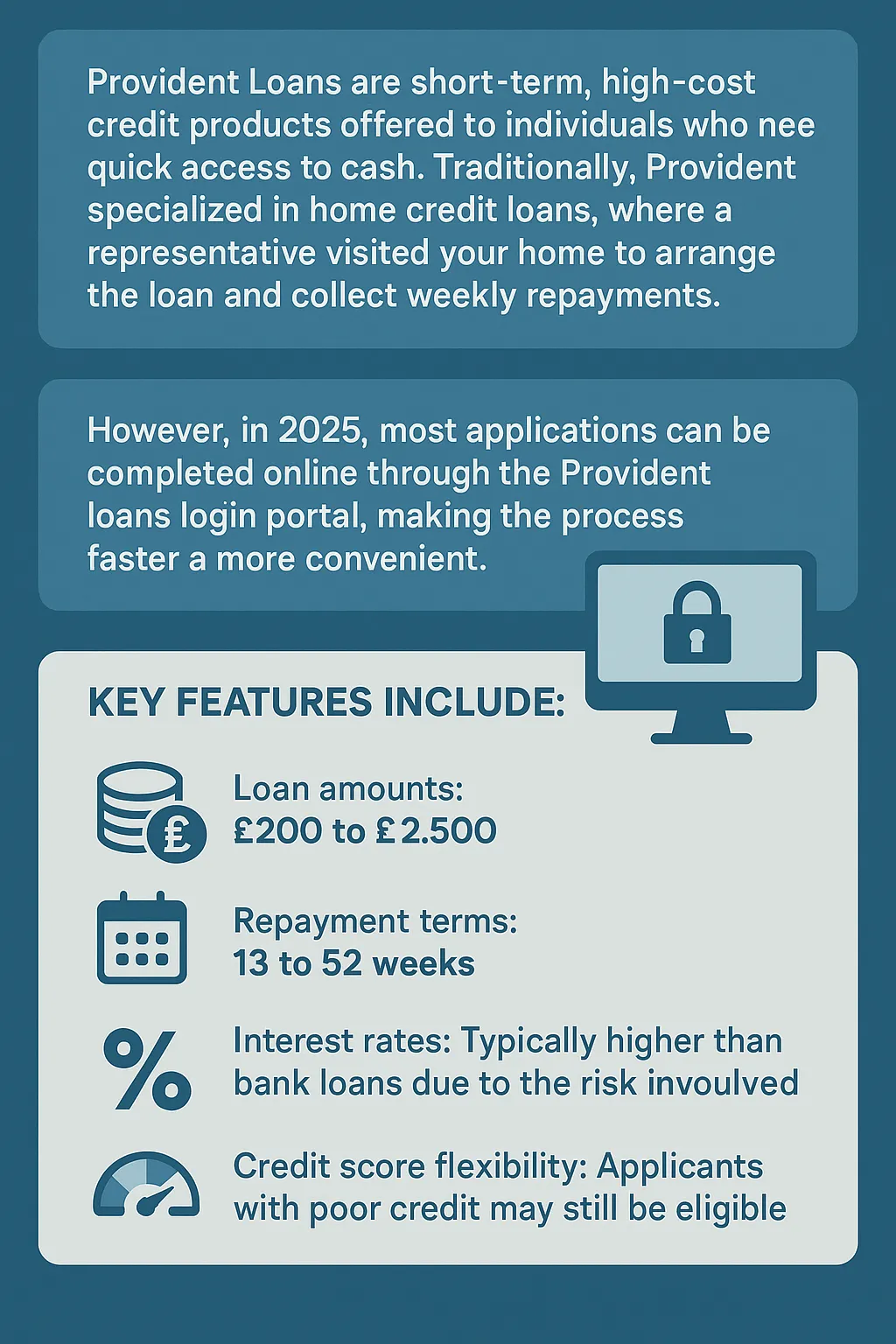

Provident Loans are short-term, high-cost credit products offered to individuals who need quick access to cash. Traditionally, Provident specialized in home credit loans, where a representative visited your home to arrange the loan and collect weekly repayments.

However, in 2025, most applications can be completed online through the Provident loans login portal, making the process faster and more convenient.

Key features include:

Loan amounts: £200 to £2,500

Repayment terms: 13 to 52 weeks

Interest rates: Typically higher than bank loans due to the risk involved

Credit score flexibility: Applicants with poor credit may still be eligible

Types of Provident Loans Available

Provident offers several lending options depending on your financial needs:

1. Personal Provident Loan

Designed for individuals needing quick cash for everyday expenses, medical bills, or small purchases.

Loan sizes: £200–£2,500

Weekly repayment plans available

No upfront fees

2. Short-Term Provident Loans

Ideal for those who need funds for a few months only.

Terms: 13–26 weeks

Lower total interest than longer loans

3. Provident Home Loans

Still available for those who prefer face-to-face interaction. A local agent visits your home to arrange the loan and collect repayments.

4. Provident Doorstep Loans

Doorstep loans are small, short-term cash loans delivered directly to your home by a lending agent

How to Apply for a Provident Loan

Applying for a Provident loan is straightforward. Here is a step-by-step guide:

Check your eligibility

UK resident aged 18+

Valid ID and bank account

Proof of income or benefits

Visit the Provident Loans website

Start your application online or use the Provident loans contact number for assistance.

Choose your loan amount and term

Use the online calculator to estimate weekly repayments.

Submit required documents

Proof of identity

Income verification (if applicable)

Wait for approval

Most decisions are made within 24–48 hours.

Provident Loans Login: Managing Your Account

Once your loan is approved, you can use the Provident loans login portal to:

View your balance and repayment schedule

Make online payments

Apply for additional loans if eligible

Contact customer support

If you face issues with Provident loans login, use the “Forgot Password” option or call Provident loans contact number for help.

Provident Loan Repayment Options

Provident offers flexible repayment terms:

Weekly repayments: Traditional method, often collected by an agent or paid online

Monthly repayments: Available for larger loans

Early repayment: You can repay early to save on interest costs

Late payments may incur extra charges, so always contact Provident if you anticipate repayment difficulties.

Provident Loans Contact Number & Support

If you need help with your account, loan application, or repayment queries, reach out to customer service:

Phone: Listed on the official Provident website

Email: Support team replies within 1–2 business days

Live chat: Available during working hours for quick help

Provident Loans Review: Real Customer Experiences

Before taking any loan, it’s important to read Provident loans reviews from real borrowers.

Positive feedback includes:

Quick approval times

Friendly customer service

Flexible repayment options

Negative feedback often mentions:

High interest rates compared to banks

Limited loan amounts for first-time borrowers

Overall, customers appreciate the convenience and accessibility of Provident loans, especially for those with limited credit history.

Provident Loans for People with Bad Credit

Many people search for Provident loans bad credit options. Provident considers applications from those with low credit scores, but:

Interest rates may be higher

Loan amounts might be smaller

Repayment history with Provident can improve your credit profile over time

Alternatives to Provident Loans

While Provident loans are popular, you might also consider:

Credit unions: Lower interest rates, but stricter eligibility

Online lenders: Some offer competitive rates for short-term loans

Government assistance: For individuals on benefits or facing financial hardship

Frequently Asked Questions (FAQ)

1. How much can I borrow with Provident loans? Between £200 and £2,500 depending on your eligibility and repayment capacity.

2. How do I access Provident loans login? Visit the official website and enter your credentials.

3. What is the Provident loans contact number? Check the official Provident website for the most up-to-date phone number.

4. Can I repay my Provident loan early? Yes, early repayment can save you interest costs.

5. Are Provident loans reviews positive? Most borrowers report good customer service and easy application processes, but interest rates are higher than bank loans.

Conclusion: Should You Choose Provident Loans?

If you need quick access to cash, have a less-than-perfect credit history, or want a straightforward repayment plan, Provident loans can be a suitable option. However, always compare interest rates, read Provident loans reviews, and borrow only what you can comfortably repay.

For many UK borrowers in 2025, Provident loan products remain a practical solution for short-term financial needs.