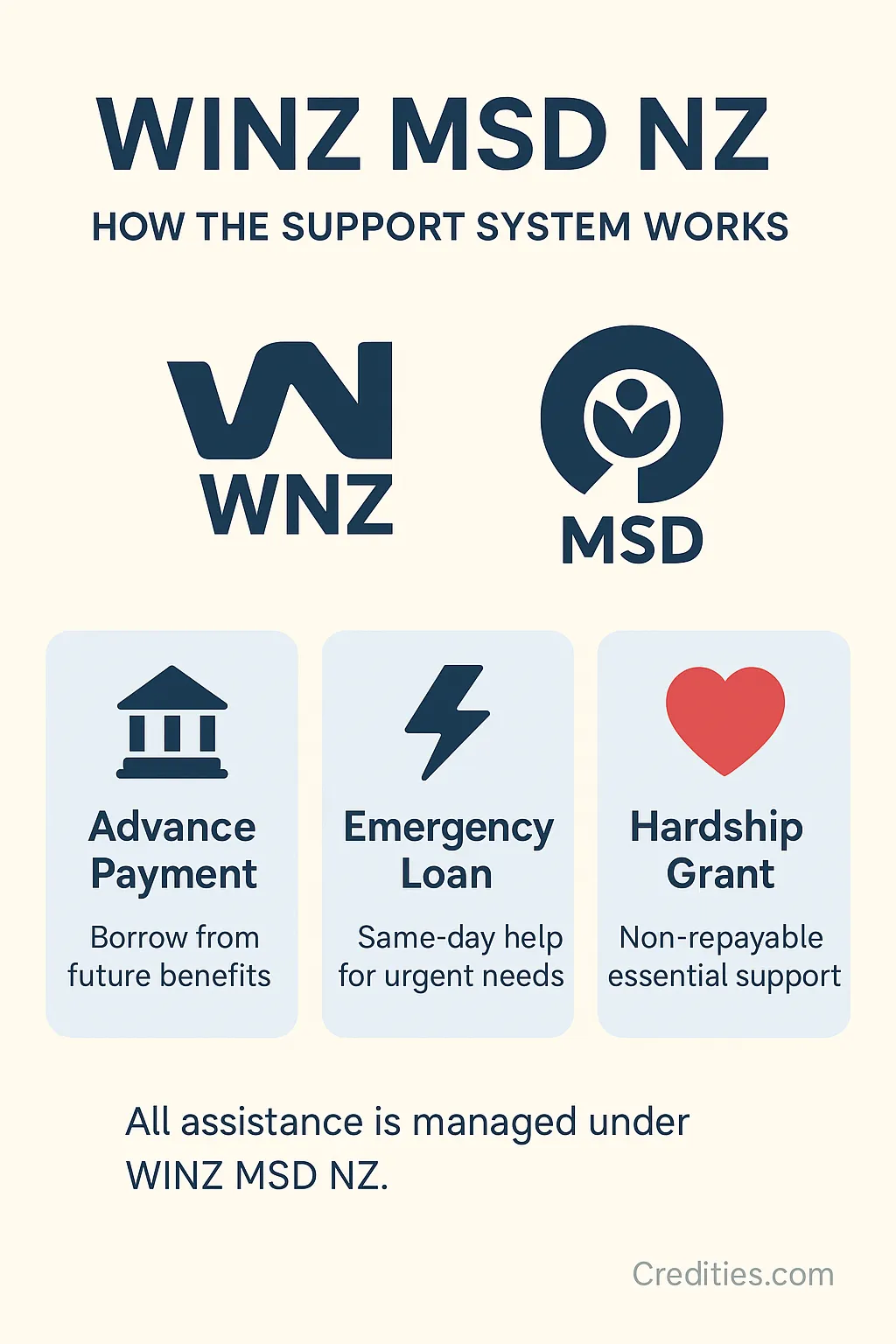

If you’re receiving financial support from WINZ MSD NZ (Work and Income – Ministry of Social Development), you may be eligible for extra help through short-term loans or emergency payments.

These WINZ loans can cover urgent needs like rent, bills, food, or car repairs when regular benefits aren’t enough. Depending on your situation, MSD may offer an advance payment, a hardship grant, or an emergency loan — often with same-day approval.

Below, we explain all available WINZ loan options in New Zealand — how they work, who can apply, and how to access support online.

WINZ Loans NZ – What They Are and Who Qualifies

WINZ loans are short-term financial supports provided by WINZ MSD NZ for people facing unexpected costs. They’re interest-free advances that help cover rent, utilities, or essential items when your regular benefit isn’t enough. To qualify, you must already receive a benefit or income support from the Ministry of Social Development.

MSD Emergency Loan NZ – Instant Help for Unexpected Expenses

An MSD emergency loan is designed for urgent needs such as medical bills, food, or car repairs. Through WINZ MSD NZ, you can apply for same-day assistance if your situation is critical. Approval depends on your current benefit type, previous advances, and proof of immediate hardship.

WINZ Advance Payment NZ – How It Works and How to Apply

A WINZ advance payment lets you borrow part of your future benefit to manage essential costs now. It’s repaid automatically through small deductions from future payments. WINZ MSD NZ offers this option for bills, rent, or school costs, and you can apply directly via MyMSD or at a local service centre.

⚠️ Although referred to as a ‘WINZ loan’, it’s technically an interest-free advance payment provided under the Ministry of Social Development (MSD) support system.

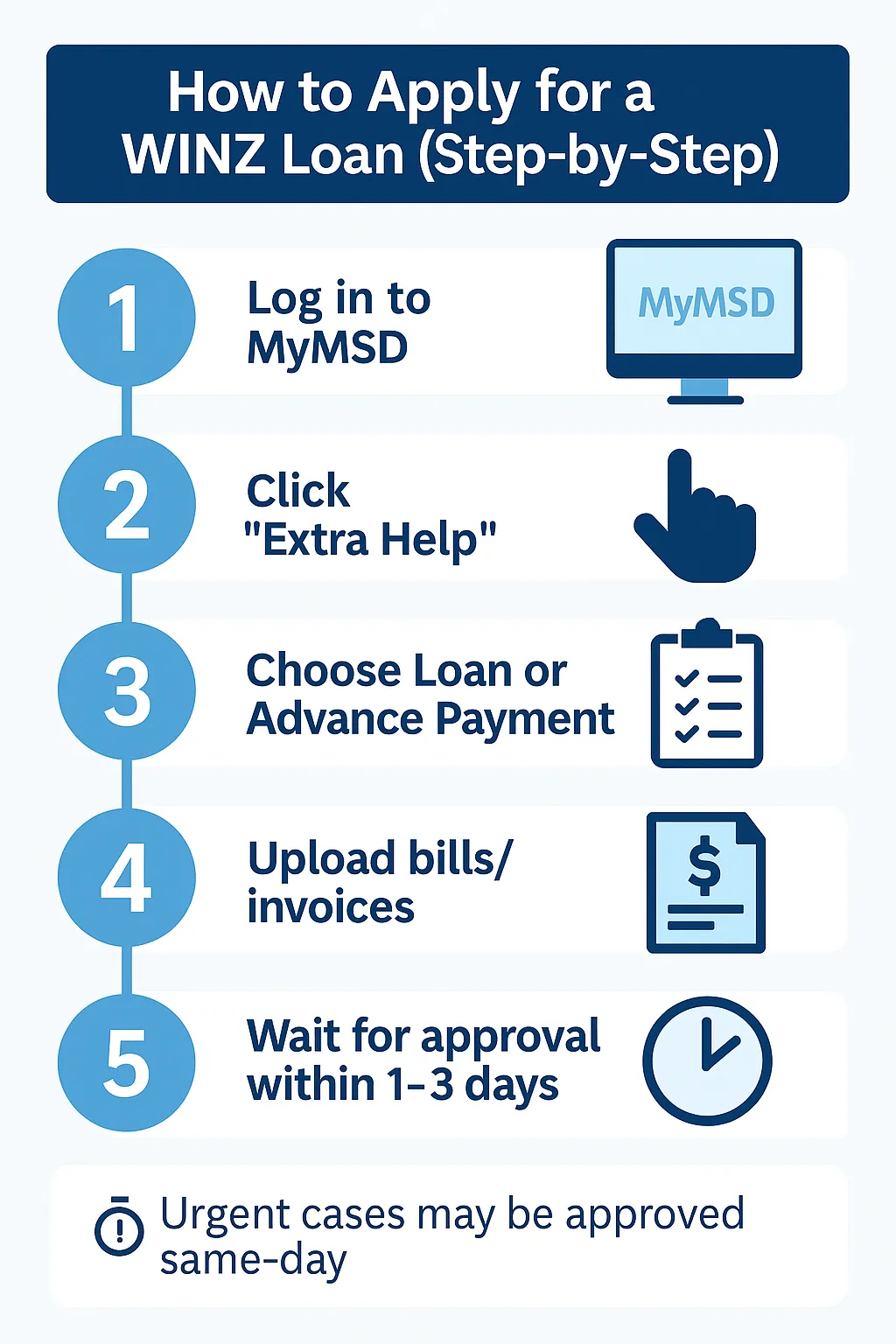

WINZ Loan Application Online – Step-by-Step Guide

You can apply for WINZ loans online through the MyMSD portal. Log in, choose “Apply for assistance,” and follow the prompts for a loan or advance. WINZ MSD NZ may ask for supporting documents such as invoices or proof of expense before approving your request. Most responses are given within 24–48 hours.

WINZ Benefit Loan Eligibility Criteria Explained

To be eligible for a benefit loan from WINZ MSD NZ, you must receive a regular benefit (like Jobseeker, Sole Parent, or Supported Living Payment). You also need to show genuine financial hardship and no other way to cover the expense. Approval depends on your repayment ability and prior advances.

WINZ MSD Loan for Beneficiaries – What Support You Can Get

Beneficiaries can access WINZ MSD NZ loans to cover emergency needs without high-interest lenders. This support helps with rent, household goods, or transportation. If you’re receiving WINZ benefits, you can apply for an advance or special needs grant based on your income and family situation.

⚠️ In most cases, a WINZ loan means an advance on your regular MSD payments, not a commercial loan.

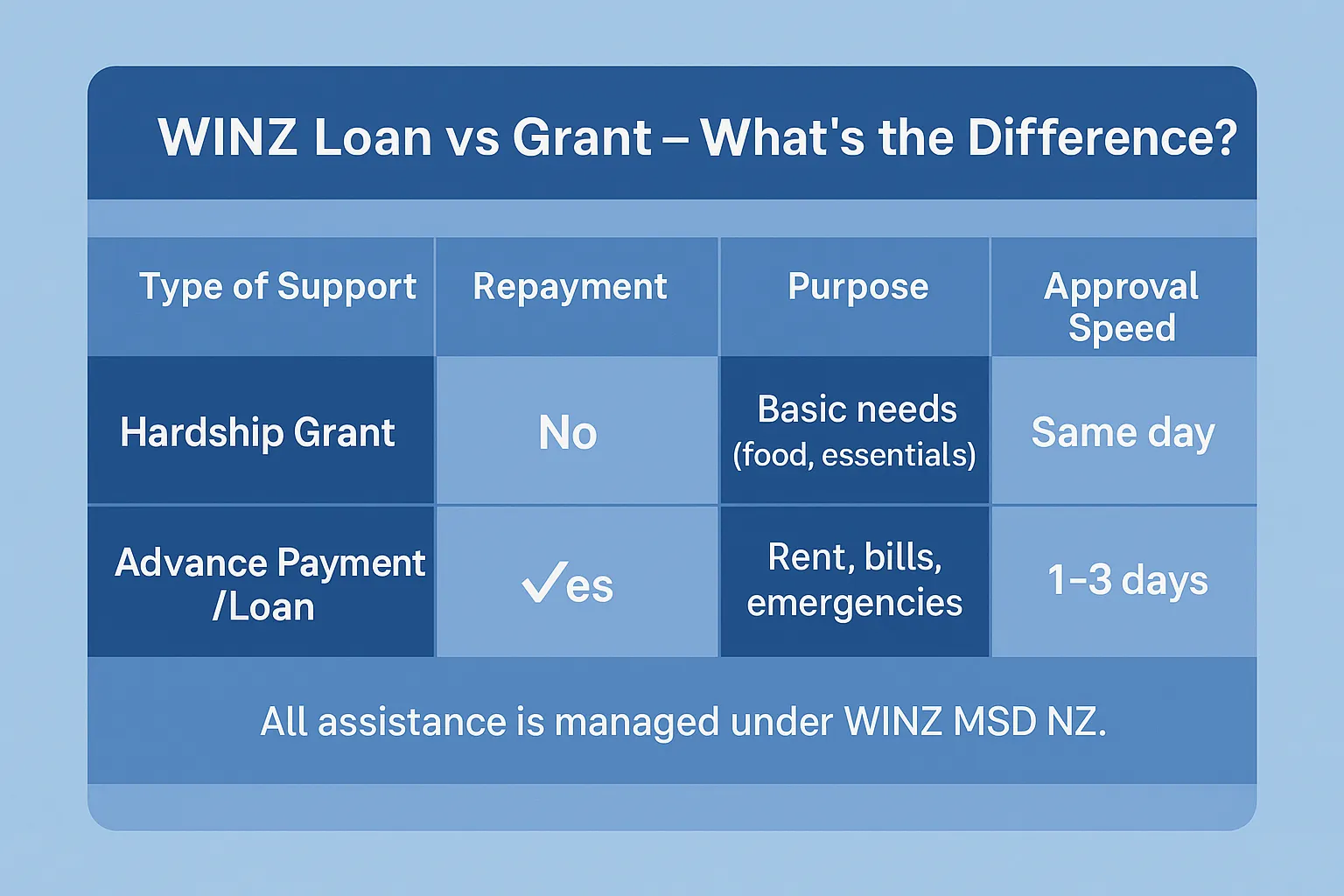

WINZ Hardship Grant or Loan NZ – What’s the Difference?

A hardship grant from WINZ MSD NZ doesn’t need to be repaid, while a loan or advance payment does. Grants are for essential, non-recoverable costs, like food or emergencies. Loans are repayable over time. WINZ decides which form of help suits your situation best after assessing your application.

WINZ Emergency Payment Same Day – When and How It’s Possible

If your need is critical, WINZ MSD NZ may approve a same-day emergency payment. These are issued for urgent housing, medical, or food expenses. Visit a WINZ office or call early in the day to speed up the process, and provide documents showing why you can’t wait until your next benefit date.

MSD Advance Payment for Rent, Bills and Food – Essential Assistance

The MSD advance payment helps cover essential living expenses such as rent arrears, overdue bills, or groceries. Through WINZ MSD NZ, you can apply online or in person. These advances are interest-free and repaid gradually from your future benefits, providing practical relief during financial stress.

How to Apply for a WINZ Loan NZ – Documents and Tips

To apply for a WINZ loan, log in to MyMSD, fill out the “Extra help” section, and attach documents like bills or quotes. WINZ MSD NZ reviews your financial records to confirm hardship. For faster approval, keep your contact info updated and be ready to explain your urgent need clearly.

Conclusion: WINZ MSD NZ Loans Offer Real Support When You Need It Most

The WINZ MSD NZ loan system provides essential financial help for New Zealanders who receive government benefits and suddenly face unexpected costs. Whether it’s an advance payment, an emergency loan, or a hardship grant, each option is designed to prevent financial stress without relying on high-interest lenders.

If you’re struggling with rent, bills, or basic needs, applying for WINZ or MSD support can make a real difference. These payments are interest-free, easy to apply for through MyMSD, and often processed within a day for urgent cases. Always check your eligibility and keep in touch with your case manager to access the right type of help quickly.

Frequently Asked Questions about WINZ MSD NZ Loans

1. Can I get a WINZ loan if I already have another advance payment? → Yes, but WINZ MSD NZ will review your current repayment schedule first. You may still qualify if the new request is for a different essential need or if your financial situation has changed.

2. How long does it take to get a WINZ loan approved? → Most WINZ MSD NZ loans are processed within 1–3 business days. In urgent hardship cases, same-day decisions and payments are possible, especially for food or emergency housing needs.

3. Do I have to pay interest on a WINZ or MSD loan? → No. All WINZ loans and MSD advance payments are interest-free. The repayment is automatically deducted from your future benefit payments over several weeks or months.

4. Can beneficiaries apply for a WINZ loan online? → Yes. Beneficiaries can apply directly through the MyMSD portal by selecting “Extra help” or “Advance payment.” Applications can also be made in person at a WINZ service centre.

5. What’s the difference between a WINZ loan and a hardship grant? → A hardship grant from WINZ MSD NZ doesn’t need to be repaid — it’s for non-recoverable essentials like food or medical costs. A loan, however, must be repaid gradually from your benefit.